- Summary:

- Gold price (XAU/USD) slumps as the FOMC's hawkish stance and the rise in long-term bond yields drive flows away from the yellow metal.

Gold price resumed the downtrend for the second straight session after new offers hit the yellow metal . The renewed slump follows a rise in long-term bond yields and the hawkish FOMC statement on Wednesday.

The FOMC statement and the equally hawkish comments from the FOMC Chair Jerome Powell set the stage for increased offers on gold, as long-term bond yields rose by 4.68% on Thursday.

A rise in US bond yields drives capital flows away from the non-yielding metal and into higher-yielding channels. Nine board members now want rates raised by 2022 (compared with 7 in June), and the FOMC Chair now says inflation may stick around for longer than expected before moderating.

The prevailing mood on the XAU/USD remains heavily bearish and gold price is down 0.78% as of writing.

Gold Price Outlook

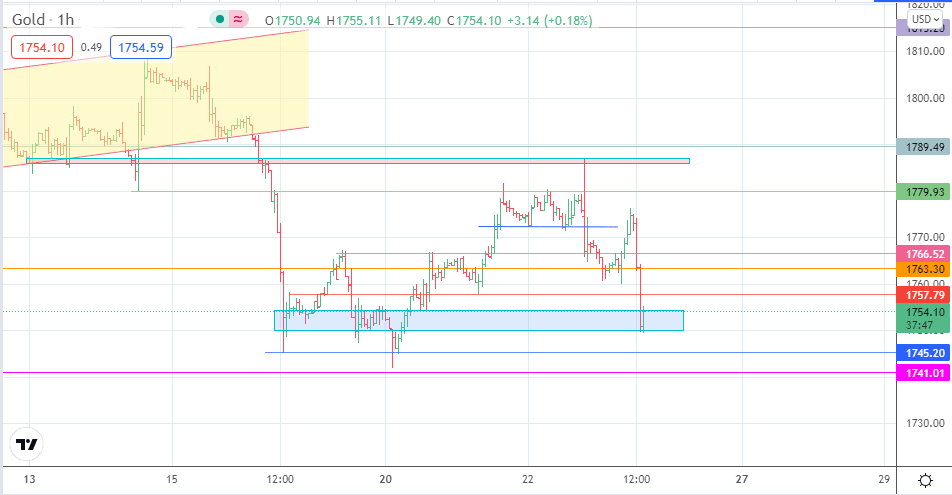

We double down to the 1-hour to provide trade ideas for the rest of the week. The triple top pattern completed its measured move and bounced off the 1763.30 support level before retesting the neckline of the triple top. Selling on the rally resumed at this price level, targeting the floor of the support zone at 1749.79. Price remains within this zone presently, but a breakdown of this zone opens the door towards 1745.20 initially, before 1741.01 comes into play.

On the flip side, a recovery from the support zone targets 1757.79 initially, before 1763.30 and 1766.52 become new targets to the north. A further extension brings the pattern’s neckline into the picture.

Gold Price (XAU/USD)

Follow Eno on Twitter.