- Summary:

- Gold price action saw another day of gains after US long term yields fell for a 5th straight day and buyers seek to hedge against inflation.

Gold price action on the XAU/USD chart is seeing a 5th straight day of gains, fuelled by the greenback’s weakness across the board on the second trading day of August. The background for the rise in gold prices and weakness of the US Dollar stems from the last FOMC decision, which delivered an underwhelming 50 bps price move that has been seen as a pointer to less hawkish future actions by the Fed.

This has led to a drop in long-term US bond yields, making these assets unattractive compared to gold, which serves as an inflation hedge. As a result, the long-term yield on the 10-year US Treasury note was down 0.62% on the day, marking a 5th straight day in negative territory. The US10Y asset lost 2.9% in Monday’s trading.

The recent gains in gold prices have been accelerated by safe-haven buying as traders seek to protect their holdings against sky-high inflation. The US, UK, and several countries are presently seeing inflation at 4-decade highs. The gold price is up 0.38% at the moment.

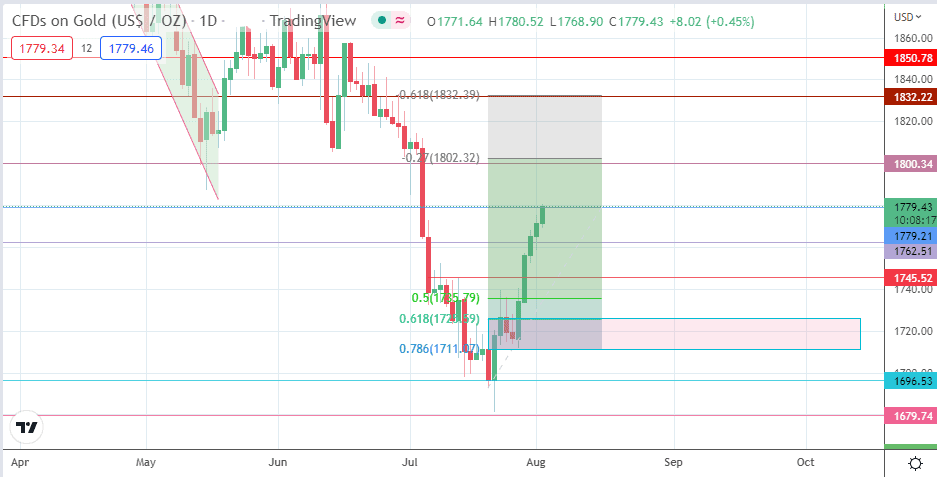

Gold Price Outlook

The active daily candle is testing the resistance at 1779 (11 January high). If there is a breakout at this level, the bulls will have a clear access route toward the 1800 psychological resistance mark. Above this level, the 20 May low/29 June high will provide an additional resistance at 1832.

Finally, the 26 January high/14 February low at 1850 and the 1877 price mark, where the 13 June high resides, are the two targets the bulls have at their disposal if there is a further price appreciation. On the other hand, rejection and retracement from 1779 will have 1762 () and 1745 () as the initial downside targets.

An additional price dip will bring in the 50% Fibonacci retracement levels at 1735 (25 July high). Below this level, the demand zone between the 61.8%/78.6% Fibonacci retracement levels at 1711/1725 becomes the next major support. Only when the gold price activity takes out the 1696 (14 July low) and 1679 (21 July low) price pivots will the downtrend resume.

XAU/USD: Daily Chart