- Summary:

- The gold price forecast is for the yellow metal to continue facing headwinds as Fed Chair insists on future rate hikes to curtail inflation.

Today’s gold price forecast sees the XAU/USD pair facing additional downside pressure. This downward pull on gold follows yesterday’s comments by Fed Chair Jerome Powell at a Wall Street Journal event in New York, in which he doubled down on the intent of the Fed to aggressively curtail inflation using higher interest rates.

Although Jerome Powell’s comments provide additional tailwinds to the US Dollar, fears of higher inflation are also bringing some demand into gold, limiting the downside move of the day. However, gold price forecasts indicate that the impact of the Fed Chair’s statement may prove to be an overwhelming factor in deciding where the price goes.

Spot gold price has been trending downward since the Fed first raised interest rates by 25bps in April 2022. A further half-a-percent rate hike this Month further softened the yellow metal, even as consumer inflation data appear to show a peak.

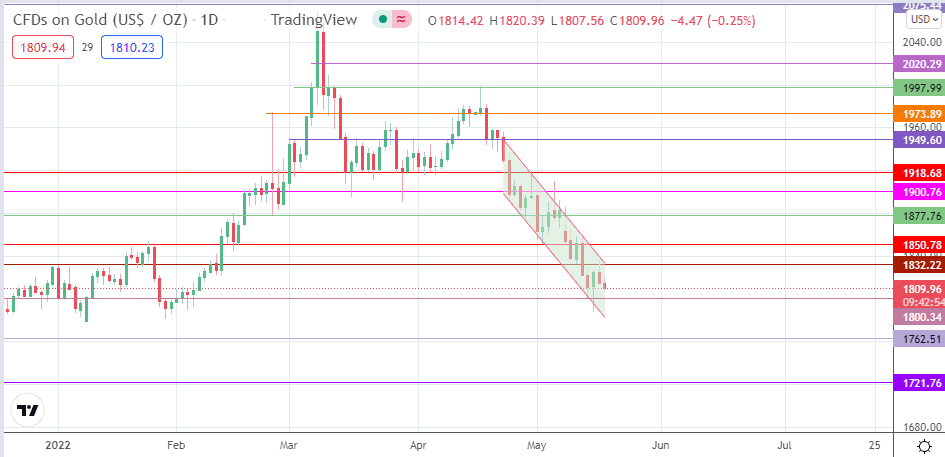

Gold price is down 4.49% in May after pushing to a low of 1810.42 this afternoon. On the day, the XAU/USD pair is down 0.29% as of writing and still looks under pressure as it pushes toward nearby support at $1800.

Gold Price Forecast

The XAU/USD pair looks set to challenge the support at the 1800.34 psychological price mark, where the lows of 2 February and 13 May were located. A breakdown of this price level opens the door for the bears to aim for the 1762.51 support (3 November 2021 and 2 December 2021 lows). Below this price mark, additional targets to the south are seen at the 10 August 2021/29 September 2021 lows at 1721.76, before 1680.00 (8/31 March double bottoms) come into the picture.

On the flip side, a bounce on the 1800.34 support allows for a push that challenges the 1832.22 resistance (31 December 2021 and 9 February 2022 highs). The 1850.78 price mark (25 January high and 9 May low in role reversal) constitutes an additional target to the north. Above this level, potential harvest points for the bulls reside at 1877.76 (15 February high and 28 April low) and at the 1900.76 psychological resistance mark.

XAU/USD: Daily Chart