- Summary:

- Gold price (XAUUSD) trades in a range, but this could change if the Fed Chair and incoming US President make speeches that affects USD sentiment.

Gold prices continue to trade in the narrow range of the last three days, as the market buzz surrounding the asset on Thursday is the speech by US Fed Chair Jerome Powell. This speech may touch on when the Federal Reserve may start to cut down on the quantitative easing program that was restarted at the onset of the coronavirus pandemic.

US bond yields have been on the increase lately. Markets would be looking to see if Powell hints at what the Fed would do about the QE program. Traders are gravitating to the stock market and driving new highs. The expectation of economic growth with the rollout of coronavirus vaccines, as well as a vastly expanded fiscal stimulus from a new US administration, could allow for higher long-term interest rates. This could provide a pathway to reducing the QE package. However, nothing is set in stone and Powell’s words would determine price action on the XAUUSD pair.

Furthermore, the incoming US President is to make a speech in Friday’s early hours, which could contain details of a vastly expanded stimulus that exceeds $2trillion.

Technical Levels to Watch

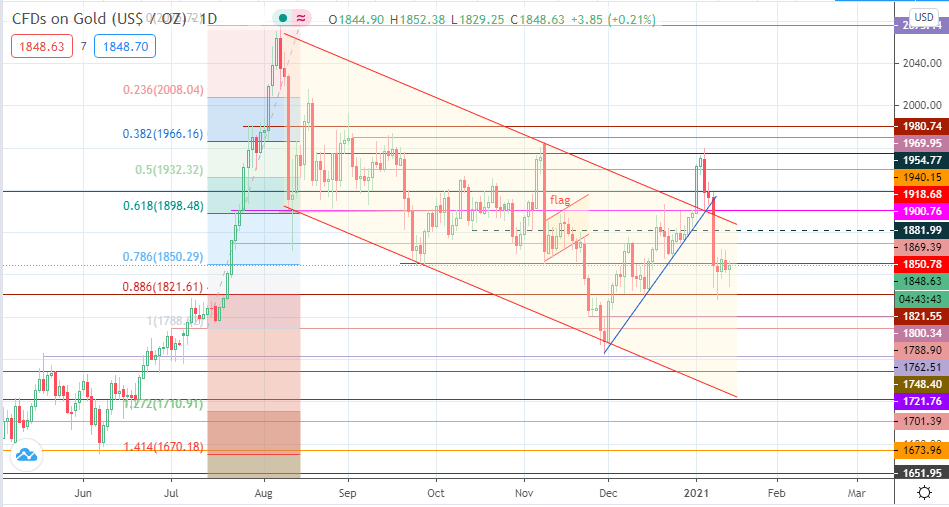

1847.52, after hitting resistance at 1850.78. This rejection keeps gold prices within the range formed by 1850.78 above, and 1821.55 below. A break above 1850.78 targets 1869.39, with 1881.99 and 1900.76 serving as additional upside targets.

Conversely, a drop from present levels targets 1821.55, but a breakdown of this floor targets 1800.34. Below this level, additional support levels sit at 1788.90 and 1762.51.

XAUUSD Daily Chart