- Summary:

- Gold price consolidating in a contracting triangle that could break both ways. However, the bearish bias exists as the price needs to retest a trendline.

The gold price sits in a tight range ever since it broke above the $2,000 level. The break to a new all-time high marked not only a record price, but it drew investors’ attention to the yellow metal and what it stands for.

Gold has long been viewed as an alternative investment. It protects a portfolio from inflation, and for this reason, many investors add gold as part of their other assets in the portfolio.

The idea of portfolio diversification is to obtain the benefits by adding uncorrelated assets. For instance, a portfolio having two risky assets will benefit by adding a risk-free (i.e., U.S. Treasury) asset. Moreover, to the new mix, by adding an asset that has a low correlation with the risky assets in the portfolio will further increase the returns.

For this reason, investors prefer not to go all-in gold, but to allocate gold to a portfolio of risky assets and risk-free assets. Thus, the diversification benefits are obtained.

More Institutional Investors Turn to Gold

Institutional investors focus the most on alternative investments, for the exact reason mentioned earlier – to protect the value of their investments (i.e., hedge against inflation).

Since gold denominated in U.S. dollars made a new all-time high, it caught the attention of many institutional investors that failed to diversify into alternative investments so far. Or, the part dedicated to alternative investments was too small.

So is the case with a $16 billion Ohio Police & Fire Pension Fund that just approved a 5% allocation for gold. Demand, therefore, exists.

Gold Price Technical Analysis

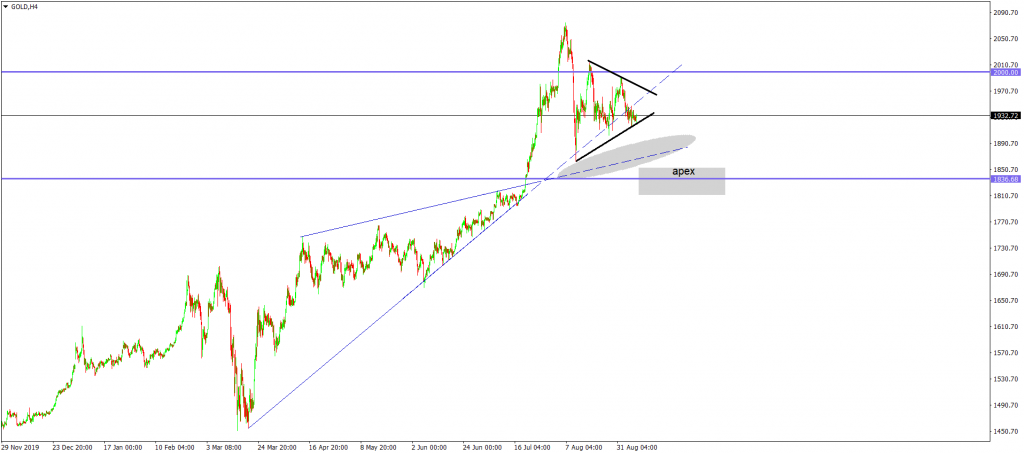

The gold price went nowhere recently. It forms a contracting triangle right below the $2,000, and this triangle can break in both directions.

However, if we use the apex of the previous triangle and consider the fact that the market did not retest the b-d trendline, then the bias is that the current triangle will break lower. If that is the case, bears would want to enter on a move below $1,903 and target $1,800, with $1,950 stop-loss.

Gold Price Forecast