- Summary:

- Gold price retreats from daily highs around 1,474 area as the positive momentum is still intact. Gold is getting a hand from the escalation in US – China

Gold price retreats from daily highs around 1,474 area as the positive momentum is still intact. Gold is getting a hand from the escalation in US – China trade war tensions.

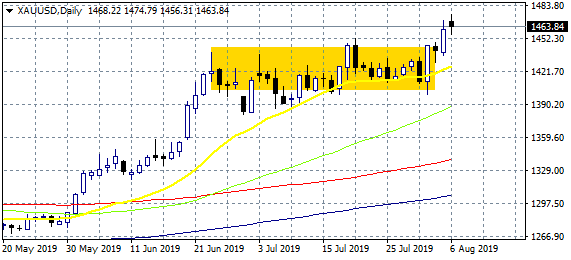

The low for the day is at $1,456.31 and the high at $1,474.79 just shy of the 1,488 target. The main trend is still bullish and now the short term momentum also shifted to the upside. In the mid-term, gold prices are trading sideways between $1381, and the year-to-date high at $1474.

Gold price has created a rectangle since mid June which considered a continuation pattern. The price moved sideways between 1,405 and 1,448 all these days and yesterday broke convincingly above that can lead to move up to 40 dollars at 1,488.

Immediate support for the yellow metal stands at $1,426 the 20 day moving average (yellow line), then at $1,400 and $1,389, the 50 day moving average. On the upside resistance would be met at 1,474 today’s high and then at 1,500.

Bulls are controlling the game as long as the price holds above 1,400. A break below will question the positive momentum, but I will wait for a break below 1,390 to confirm any leg lower. The rectangle that has sketched and the break above confirmed the bullish trend. If the rectangle at 1,405 area fails to stop the price then short positions can be initiated.Don’t miss a beat! Follow us on Twitter.