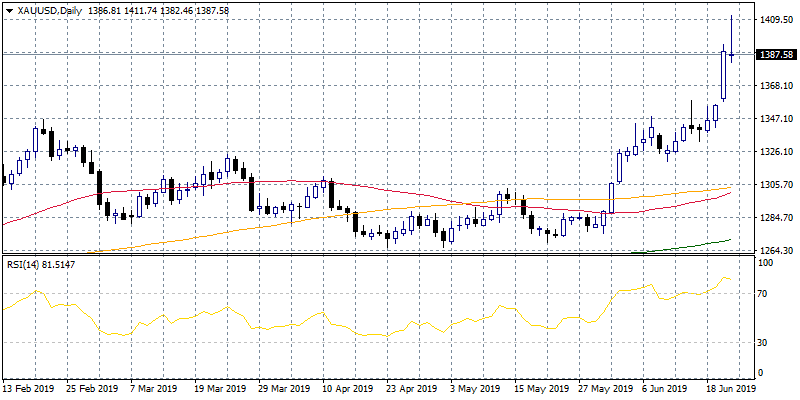

Gold continues the impressive rally making fresh five year high at 1,411. USD weakness and an escalation in USA – Iran tensions around the Hormuz Straits boosts gold. Short covering also helped for the gold to reach 1,411 a level that we haven’t seen since 2013. FED dovish minutes opened the door for more cuts before the end of the year.

The momentum is bullish for the gold as it holds above all the major daily and weekly moving averages. Our only concern is that the precious metal has reached overbought levels, so a pullback looks possible. Today the volatility is very high as gold trades in 30 dollar trading range with traders jump in and out of the market trying to catch the next wave. The immediate support for the yellow metal stands at $1,382 the daily low while more solid support can be found at the $1,357 the previous high. On the upside resistance would be met at 1411 the today’s high and then at 1,420 round figure. We are cautious on gold at current level, we are waiting a retreat, and will go long only if the precious metal closes convincingly above 1,411.