- Summary:

- Gold hits 3 month high as investor expectations that the Fed will eventually cut interest rates in the face of escalating US-China trade war, grow.

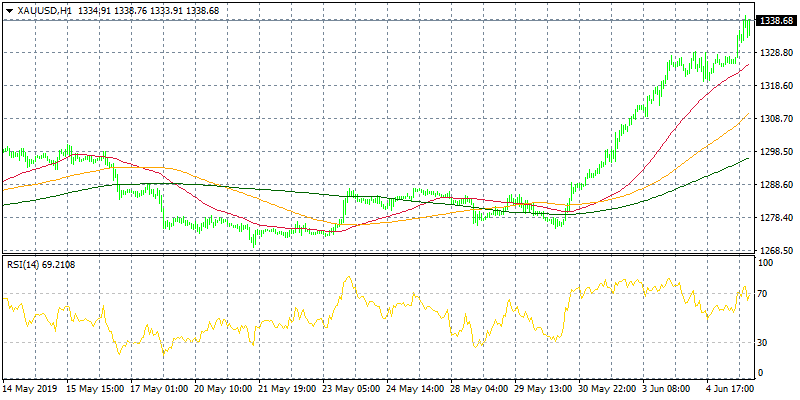

Gold hits 3 month high as investor expectations that the Fed will eventually cut interest rates in the face of escalating US-China trade war, grow. FED Chairman Powell commented that the Fed is willing to take any action in the event of a slowdown. The bond market is indicating two 25bps cuts by December 2019 and a further cut in 2020. The Greenback feels the pressure and is trading to multi week lows after rejected above 98. Also the turbulence in equity markets strengthens the safe haven status of gold. The precious metal is making higher highs and remains close to the daily high, as the bulls are in full control. The only concern is that the yellow metal has entered the overbought territory so a pullback can’t be ruled out. The immediate support for the yellow metal stands at today’s low at $1,325 while more solid support can be found at the $1,310 where the 100 hour moving average crosses. On the upside first resistance would be met at today’s high at $1,340. I am very cautious at current levels because the rally was too fast too high.

Gold Hits 3 Month High

Gold hits 3 month high

Gold hits 3 month high