- Summary:

- As new offers pour in for its Cobar mine, the Glencore share price looks set for a huge move upwards, following yesterday's flash spike.

Thursday’s crazy Glencore share price action precedes a more muted performance, with bulls managing to engineer a 0.27% gain. This move comes as it emerged that the company is considering offers for its CSA copper mine in Australia.

Glencore has been planning to sell its Cobar underground copper mine in New South Wales, Australia, for close to six years as it tries to reduce its debt profile. Glencore is considering offers for the mine presently after several attempts at selling the mine failed.

A boost in copper prices on recovery from pandemic-induced shutdowns have helped raise the valuation of the asset. From a 2013 valuation of $329million, Glencore is now expected to get at least $725 million when the deal goes through.

Glencore Share Price Outlook

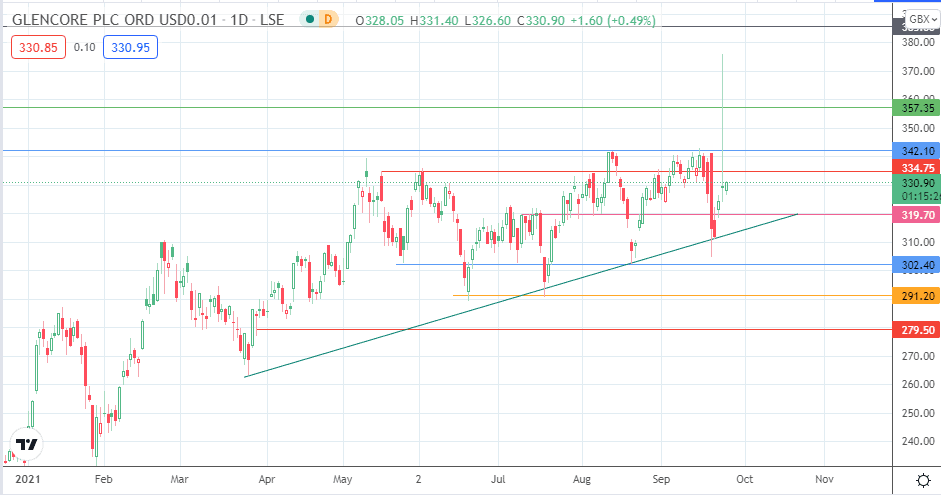

The 334.75 resistance remains the immediate upside target, and a break of this level clears the path towards 342.10. 357.35 becomes available if the advance continues, sending the Glencore share price into record territory, Thursday’s violation notwithstanding.

On the flip side, rejection at 334.75 opens the door for a pullback which targets 319.70. Declining price action is expected to test the ascending trendline support, with a successful breach to the downside gaining clear passage towards 302.40. 291.20 and 279.50 become available if the bulls are unable to defend the integrity of 319.70.

Glencore Share Price Chart (Daily)