- Summary:

- The BT share price has swung higher on the day after a positive outlook and share price upgrade by German bank Berenberg

The BT share price reversed fortunes after early losses in the Friday session and is now up 1.67%. This follows the positive outlook provided by German investment bank Berenberg.

The BT Group reinstated its final dividend last week, despite reporting lower revenues. However, the company pulled in higher-than-expected profits, with a 2% gain in EBITDA to 7.6 billion pounds. Berenberg’s analysts also said the company’s key performance indices for the 4th quarter were encouraging and showed how well its customers have reacted to price increase communications.

The bank also noted that the BT Group would face potential downside risks from the Telefonica/Liberty Global joint venture and pay negotiations with industry unions. However, Berenberg believes that BT Group’s growth would be “a watershed moment in the investment case.”

BT Group’s CEO Philip Jansen praised the group’s infrastructure arm for its amazing rollout of 5G infrastructure, saying that 50% of UK households now had coverage. Berenberg analysts have set a BT share price target of 220p, representing a potential upside of 20.21%.

BT Share Price Forecast

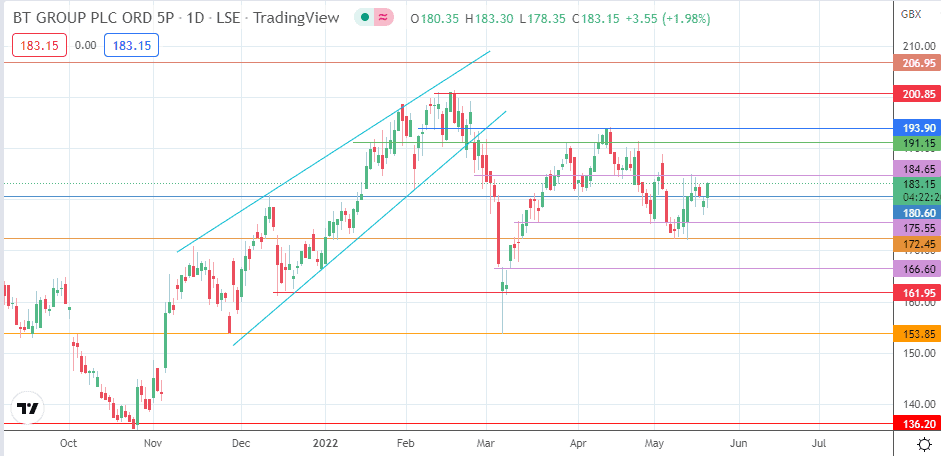

The rejection of the downside violation of the 180.60 support (18 May 2022 low) and subsequent upside push makes 184.65 the new target for the bulls. A break of this level is needed to send the price activity towards 191.15 (26 April 2022 high). Above this level, 193.90 (12 April 2022 high) and 200.85 (11/17 February highs) are additional northbound targets that may serve as harvest points for the bulls.

On the flip side, the bears would need to sequentially degrade the 180.60, 175.55 (18 March and 29 April 2022 lows) and 172.45 (13 May low) support levels to regain the momentum. This scenario would see 166.60 (9 March low) becoming available as a new target to the downside, leaving 161.95 in the running as well. 153.85 is yet another downside target with potential, having been a site of prior lows seen on 26 November 2021 and 7 March 2022.

BT Group: Daily Chart