- Summary:

- "No EU ban on Russian oil imports" is the driving force behind the bearish Brent crude oil price predictions.

Crude oil prices are still trading lower on the day, despite a shortfall in US crude oil stocks this Wednesday. Brent crude oil price predictions remain unchanged from the bearish stance after the Energy Information Administration said that US crude oil inventories fell by 3.4 million barrels

in the week ended 13 May 2022. This was a steep drop from the surplus of 8.5m barrels seen a week earlier and was also a sharper-than-expected drop from the 2.5m barrels surplus predicted by analysts.

Geopolitics remains the driving force behind Brent crude oil price predictions this Wednesday. As Commerzbank analysts noted in their investment reports, the shelving of any proposed ban on Russian oil imports by the EU has proven to be a much more powerful overriding force than reports of China’s easing of lockdowns and potential demand recovery. Reports that the US is considering easing sanctions on Venezuela is also pressurizing oil prices.

The 2.31% drop in Brent crude this Wednesday follows Tuesday’s 1.03% fall. A stronger dollar is also putting the brakes on commodity prices. Brent crude is approaching a key support at $109.58. How will this affect Brent crude oil price predictions as we advance?

Brent Crude Oil Price Prediction

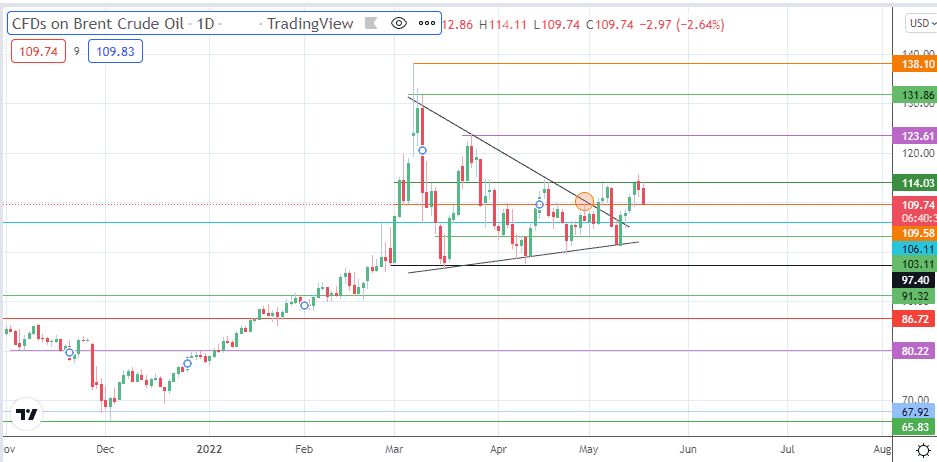

Wednesday’s decline has made the 109.58 support vulnerable. A breakdown of this support allows the bears to aim for the 106.11 support (9 March and 12 May lows). If there is further price deterioration, the 97.40 support level (28 February and 16 March lows) comes into the picture. If the decline continues unabated, additional support is seen at 91.32 (11/17 February lows).

On the flip side, a bounce on 109.58 allows for a retest of the 114.03 resistance (5/16 May highs). The 24 March high at 123.61 re-enters the picture if the bulls uncap the 114.03 resistance. The bulls’ additional harvest points reside at 131.86 (9 March high) and at 138.10 (7 March high).

Brent Crude: Daily Chart