- Summary:

- GBPUSD is under pressure today after UK inflation data; The UK Consumer Price Index (year over year) came in at 1.7%, below forecasts of 1.9% in August

GBPUSD is under pressure today after UK inflation data; The UK Consumer Price Index (year over year) came in at 1.7%, below forecasts of 1.9% in August, the monthly reading came in at 0.4%, below expectations of 0.5%. The UK Producer Price Index – Output (year over year) n.s.a came in at 1.6%, below forecasts of 1.7% for August. Retail Price Index (MoM) registered at 0.8% above expectations (0.7%) in August.

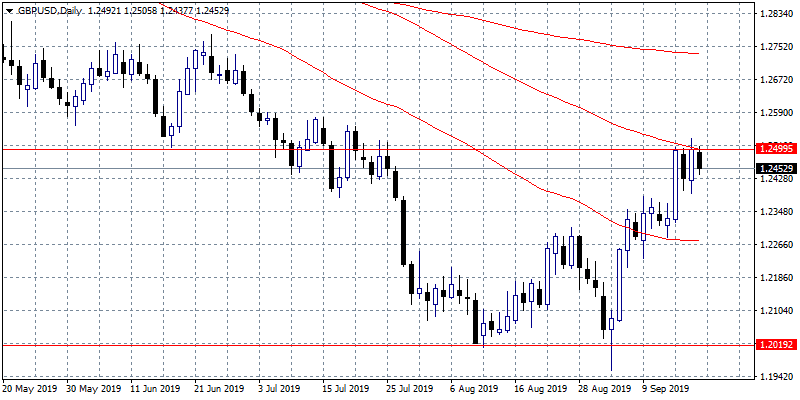

The pair hit the daily lows at 1.2437 after the inflation data but managed to rebound above mid 1.24. The cable rejected for one more time today at the 100-day moving average around 1.25, giving up as of writing 0.33% at 1.2456 as traders closely watch the Brexit drama. Bulls are still in control but the double top formation at 1.25 where also the 100-day moving average crosses increase the likelihood of a potential correction. On the upside, immediate resistance now stands at 1.2505 today’s high while more offers will emerge at 1.2735 the 200-day moving average. On the downside, immediate resistance stands at 1.2437 today’s low and then at 1.2276 the 50-hour moving average.