- Summary:

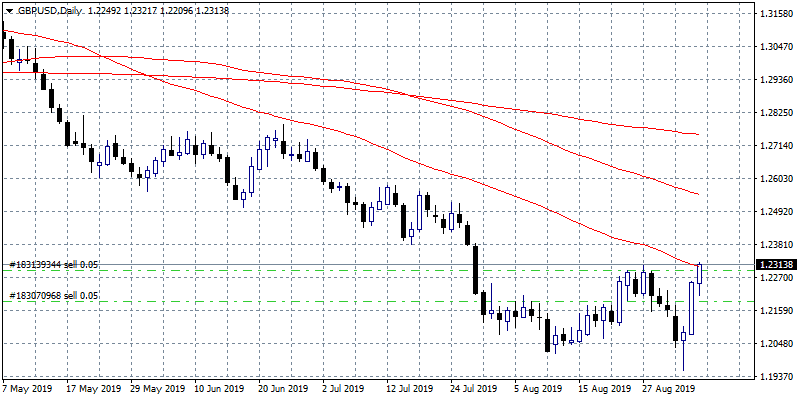

- GBPUSD trading higher for third day in a row cancelling the recent negative momentum. On the upside, immediate resistance now stands at 1.2307

GBPUSD adds 0.41% at 1.2304 after the UK Parliament voted a bill to force Prime Minister Boris Johnson to request an extension if he is unable to agree a Brexit deal with the EU. UK is scheduled to leave EU on October 31.

GBPUSD trading higher for third day in a row cancelling the recent negative momentum. On the upside, immediate resistance now stands at 1.2307 the 50-day moving average and also the daily high and then at 1.2383 the high from July 29. On the downside immediate resistance stands at 1.2209 today’s low while extra support is at 1.2073 yesterday’s. Intraday traders can enter a long position if the pair close above 1.2308 daily high, targeting a break above 1.24, a stop order should be activated at 1.2290. Short positions from here targeting 1.22 should place stop-loss orders at 1.2308.Traders must be very cautious with GBPUSD as the developments around Brexit will add to volatility.