- Summary:

- Angela Merkel's comments at the Hague on possibility of backstop agreement sends British Pound soaring broadly across major.

German Chancellor Angela Merkel said in a news conference at the Hague that a backstop agreement before deadline day was possible.

“We can also find a backstop solution by October 31,” Merkel said, sparking optimism that it would still be possible to deliver a soft Brexit. Merkel has also said that all parties would work to make the Good Friday agreement work, while ensuring the EU single market’s integrity.

The GBPUSD was energized by these comments and soared to highs not seen since the beginning of the month. As at the time of writing, the pair was up 1% at 1.2250, having touched the 1.2265 mark a few minutes earlier. However, these comments may not be enough to stave off all Brexit-related uncertainties, and this will likely limit upside price action at present levels, which is the site of July 31 highs.

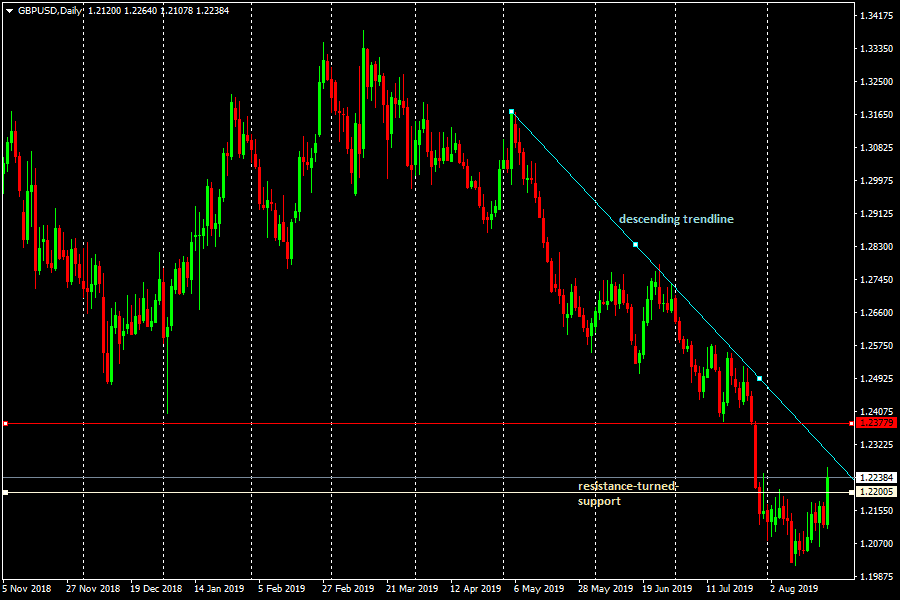

Technical Playbook for GBPUSD

The pair is currently trading at the daily R3 pivot, where the hourly candle is presently shaped like a shooting star with a closing price just under the R3 pivot. This may represent the lack of follow through on the price surge that was mentioned earlier in this analysis piece.

If the price action is able to violate the 1.22226 resistance, it will encounter a significant resistance in the form of a descending trendline which connects the highs of the price action dating back to April 22. Violation of this trendline to the upside will open the door to the 1.2377 horizontal resistance.

On the flip side, failure to breach the current R3 resistance level will send the price back to the 1.22008 near-term support, and below this will also lie support at 1.2159.