- Summary:

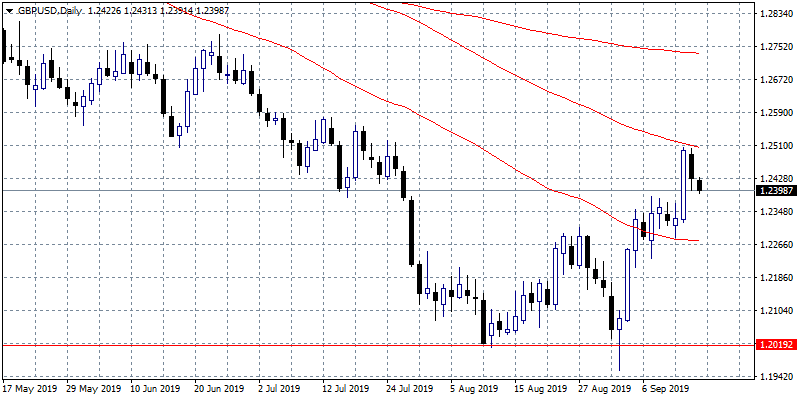

- GBPUSD continues the correction for second day after cable rejected at the 100 day moving average around 1.25, giving up as of writing 0.22% at 1.2399 as

GBPUSD continues the correction for second day after cable rejected at the 100 day moving average around 1.25, giving up as of writing 0.22% at 1.2399 as traders closely watch the Brexit drama.

GBPUSD technical outlook is neutral as the pair looks trapped between the 50 and 100-day moving average. On the upside, immediate resistance now stands at 1.2431 today’s high while more offers will emerge at 1.2503 the 100-day moving average. On the downside, immediate resistance for cable stands at 1.2391 today’s low and then at 1.2275 the 50-hour moving average. Intraday traders can enter a long position if the pair breaks above 1.2431 daily high, targeting the 100-day moving average, a stop order should be activated at 1.24. Short positions from here targeting 1.23 should place stop-loss orders at 1.2431 top. Traders must be very cautious with GBPUSD as the developments around Brexit will add to volatility.