- Summary:

- GBPUSD add over 0.30 percent today at 1.2480 lose to daily high as Boris Johnson heads to number 10. Earlier today the UK Finance June mortgage

GBPUSD add over 0.30 percent today at 1.2480 lose to daily high as Boris Johnson heads to number 10. Earlier today the UK Finance June mortgage approvals came in at 42.7k matching expectations. UK parliament is set to observe a vacation period starting from tomorrow until 3 September. So I don’t expect any notable Brexit developments during that period.

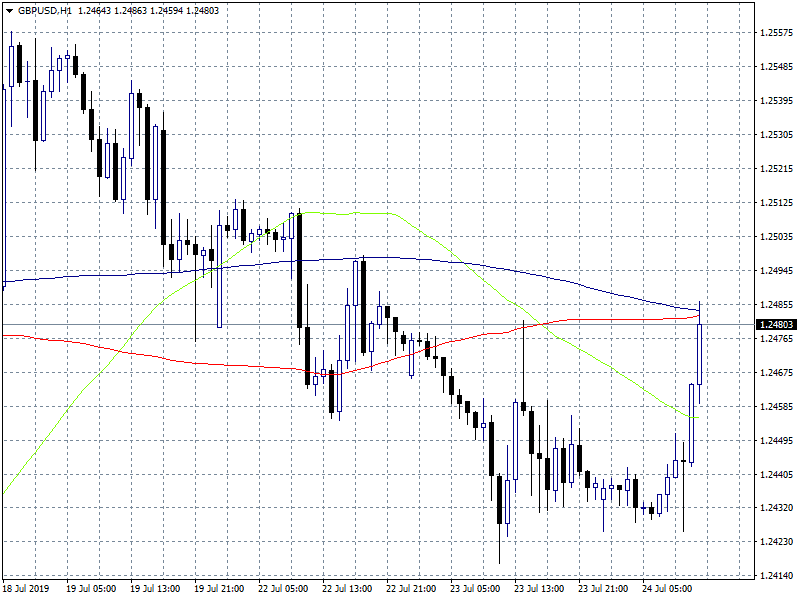

GBPUSD rebounds sharply after hitting the daily low at 1.2425 and stopped at 1.2483 just at the 10 hour moving average. The short term momentum is positive for the pair as it managed to break above the 50 hour moving average and now is challenging the 100 and 20 hour moving averages. On the downside first support for GBPUSD can be met at 1.2455 the 50 hour moving average and then at 1.2425 the daily low, while a break below can accelerate the pressure down to 1.2400. On the upside immediate resistance stands at 1.2483 the 100 hours moving average and daily high while more offers will emerge at 1.2513 the high from July 22nd. Intraday traders can enter a long position if the pair breaks above 1.2483 targeting 1.2513 high for profit, a stop order should be also activated at 1.2455.Don’t miss a beat! Follow us on Twitter.