- Summary:

- Brexit woes resurface in the UK, causing the British Pound to crash dramatically as PM Boris Johnson plots parliametary recess to block a no-deal Brexit

The British Pound lost close to 130 pips in three hours of a sustained selloff on Wednesday morning after a news reports stated that UK PM Boris Johnson intended to extend the recess period of the UK Parliament to October 14. It is thought that this move is intended to nullify any efforts by the opposition parties in the UK to block a no-deal Brexit using legislative powers.

News of a possible call for an early election if a no-confidence vote is passed by parliament next week has also crossed the wires, with the comments being credited to an unnamed top official.

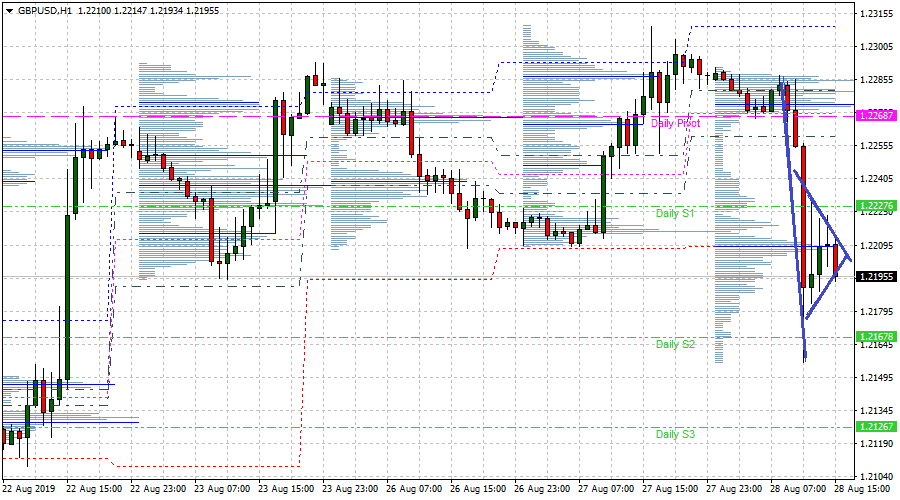

After crashing from a high of 1.2289 to an intraday low of 1.2155, the GBPUSD pair has been able to recover some ground to 1.2200, but is now in a phase of bearish consolidation.

The daily chart shows that today’s price move invalidated the potential upside break of the down trendline, while the hourly chart shows the presence of a bearish pennant pattern, with selling volume interest picking up at 1.2210.

A downside break of the bearish pennant could see the pair target the 1.2167 price area (S1 pivot), and below that the 1.2126 price level, where a cluster of previous lows between Aug 22 and Aug 24 can be found.

Further upside recovery could open the door for the pair to target the 1.2227 price level. A candle close above this level will invalidate the bearish pennant and open the way to more upside which could retest 1.2268.