- Summary:

- BoE's Andrew Bailey dampens hopes of a foray by the UK's top bank into negative interest rate territory, sending the GBPUSD higher on the day.

The GBP/USD pair jumped 0.62% after the Bank of England Chief Andrew Bailey appeared to throw out the possibility of negative rates. Bailey said he saw “lots of issues” with the sub-zero rates, adding that the move could hurt banks.

The Pound soared as a result of the statement and was also given additional propulsion from improved risk sentiment in the market, following yesterday’s risk-averse market plays.

Technical Levels to Watch

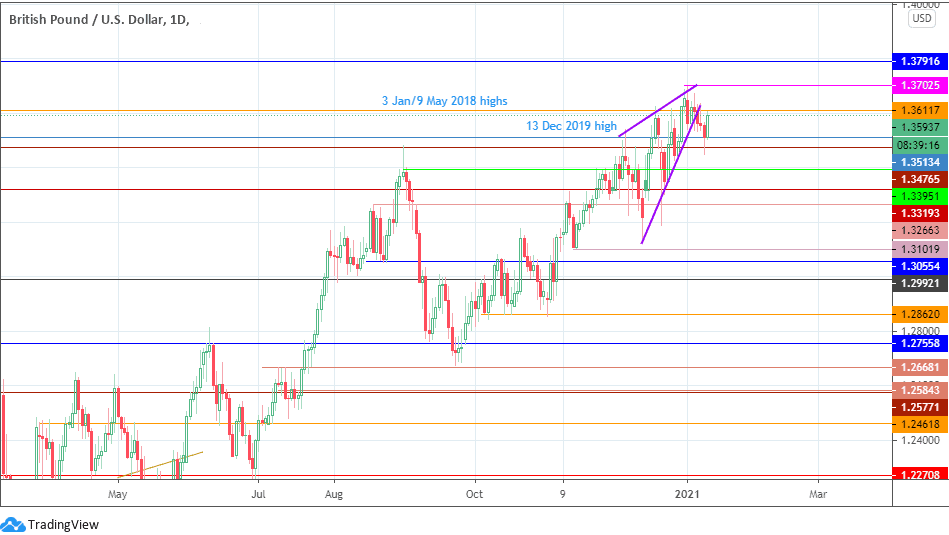

Today’s bounce looks to have truncated the bearish break from the rising wedge. However, the daily candle has met resistance at 1.36117. A resumption of the bearish move is possible, targeting 1.35134 initially, followed by 1.34765 and 1.33951 if the decline is extensive. 1.33193 is a potential price projection point.

On the other hand, a break above 1.36117 targets 1.37025 in a move which forecloses a possible bearish conclusion to the wedge pattern. 1.37916 is an additional target, attainable if bulls can transcend the highest price point for the year so far.

GBP/USD Daily Chart