- Summary:

- GBPUSD trades 0.04% lower at 1.2070 after UK wages excluding bonuses increased by 3.9% y/y compared to 3.8% y/y expected, the wages including bonuses rose

GBPUSD trades 0.04% lower at 1.2070 after UK wages excluding bonuses increased by 3.9% y/y compared to 3.8% y/y expected, the wages including bonuses rose by 3.7% y/y meeting expectations, while the ILO unemployment rate came in at 3.9% topping expectations of 3.8%.

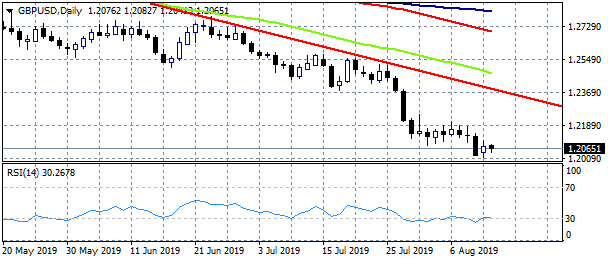

GBPUSD fights to fly away from recent lows at 1.2014 as sellers are in control. The last hour the pair breached above the 50 hour moving average, giving the bulls something to hope. On the upside immediate resistance stands at 1.2105 the 100 hour moving average while more offers will emerge at 1.2124 the 200 hour moving average. Intraday traders can enter a long position if the pair breaks above 1.2082 daily high, targeting 1.2124, a stop order should be activated at 1.2054 the daily low. Short positions targeting below 1.20 and at 1.1950 should place stop loss orders at 1.2187. All in all the momentum is bearish but as the RSI 14 in the daily chart is attempting to exit oversold levels at 30.04 there is a possibility for the pair to make a rebound above 1.21.