- Summary:

- The GBPUSD drops as Brexit woes resurface, even as the market waits for the US Core Durable Goods Orders report on this UK Bank Holiday Monday.

Today is a bank holiday in the UK, and that explains why we are not seeing much trading volume on the GBP pairs. However, Brexit-related uncertainties cropped up again this Monday and this has prompted some fresh selling on the GBPUSD. It emerged over the weekend that UK PM Boris Johnson had met with the Attorney-General of the UK to discuss the legal implications of a parliament shutdown ahead of the Brexit deadline in order to prevent any possible scenarios that would lead to a shift of the Brexit deadline.

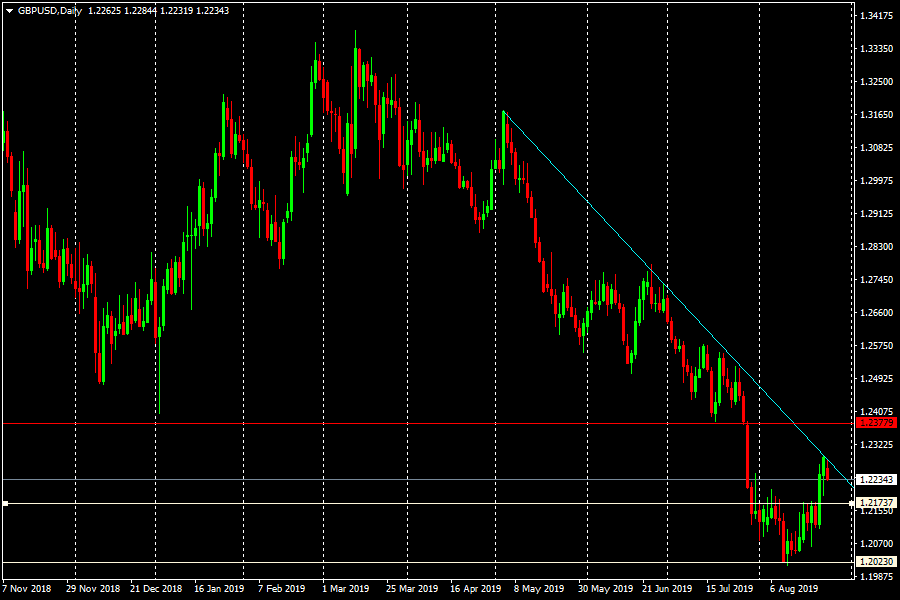

As investors look towards the US Core Durable Goods Orders report for more direction to trade this pair, we have to note that the GBPUSD was unable to continue the rally of Thursday and Friday. It has met resistance at the downtrending resistance trendline which connects the highs of price action from June 25 till date. The pair has thus extended its intraday drop to the 1.2239 region, having opened for the week at 1.2284.

The downward slide of the GBPUSD on Monday also gained some impetus from the comments attributed to the Chinese Vice Premier Liu He, in which he hinted that Beijing is ready to resolve its trade differences with Washington.

Today’s release of the US durable goods orders data (as well as its core component) would provide additional near-term trading opportunities. Downside targets for the GBPUSD in case of a USD-positive news outcome would be the 1.2173 and 1.2023 levels below that. To the upside, any recovery rally has to take the asset above the down trendline before the pair can attain the 1.2377 resistance.