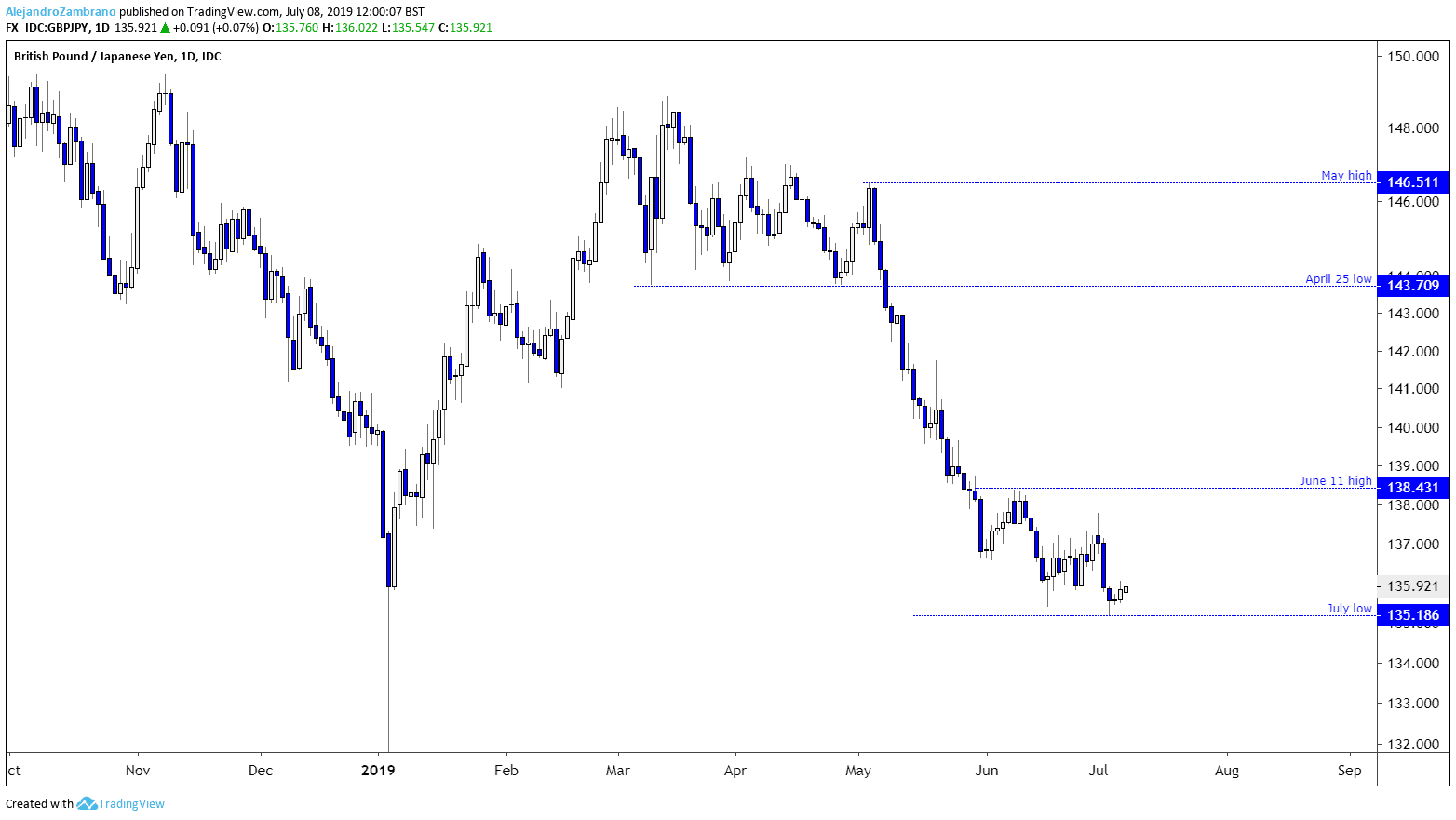

In early May when GBPJPY was trading around 143.70, I said that GBPJPY could fall sharply. The price did so and reached a low of 135.35.

As for the latest weeks, the price is really struggling to trade lower, and we have seen a few attempts to end the downtrend, the first one started June 4, followed by June 18, and now, the most recent one on July 3 is the failure of the price to trader lower on the break to the June 18 low.

I think the struggle of GBPJPY to trade lower is not centered on the British pound; it is rather the Japanese yen that is giving back gains as we can also see in other pairs such as USDJPY. The move lower in JPY (move higher in GBPJPY), is motived by higher risk-appetite, and a sharp discrepancy between stock markets prices and the JPY, where the JPY should be much lower given the strong stock markets.

As for the GBPJPY, traders are probably watching the 138.43 high as the price trend is bearish below this level, and if bullish traders manage to lift the price above it, we could see a 50% correction of the slide from the May high of 146.51 to the July 3 low of 135.26. The 50% correction level is at 140.76.

As for bearish traders, they will probably try to short sell near the June 11 high. However, I think it can be better to wait for the market to trade sideways for longer until it formed some sort of pattern and then trade it. As the price action looks right now, the market might try to form a rectangle pattern over the next few weeks.Don’t miss a beat! Follow us on Twitter.