- Summary:

- Lacklustre data from South Africa gives the GBP/ZAR some reprieve, but a key resistance needs to be broken for the recovery to take root.

The GBP/ZAR is up 0.18% this Wednesday, extending the pair’s winning streak into the second day. This follows the release of lacklustre trade balance data by the South African Revenue Services, keeping the Rand on the back foot against other major currencies.

The South African trade balance came in at 24.76 billion, which was lower than the consensus of 25.5 billion. This number is considered a lacklustre performance, keeping with the country’s economic outlook amid its energy crisis and struggle to recover from the COVID-19 pandemic.

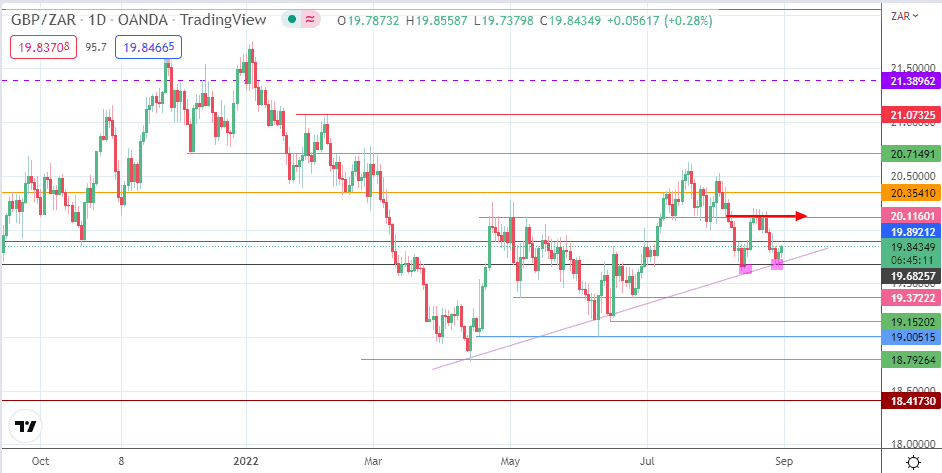

The week features very little in terms of market-moving fundamentals for both currencies. This leaves the pair susceptible to plays that are based on technical analysis. The daily chart of the GBP/ZAR shows that the 20.11 price resistance is the critical barrier which will either confirm the bottoming pattern with its attendant upside move or a resumption of the Pound’s slump.

GBP/ZAR Forecast

The bounce on the support at 19.68257 (13 June high and 5 July 2022 low) and the ascending trendline that connects the lows of 13 April, 16 June and 29 August 2022 sets up the potential for a double bottom formation. This pattern will only be complete if the bulls take out the 19.89212 resistance and the neckline at 20.11601. Successful clearance of the latter sets up the potential for the measured move’s completion at 20.71491 (24 January and 11 February highs). This target only becomes visible if the bulls also achieve clearance of 20.35410 (8 July high).

This outlook is invalidated if the 19.68257 support breaks down, targeting 19.37222 initially. A further decline brings the 14 June 2022 low at 19.15202 into the picture. Other targets to the south at 19.00515 (9 June low) and 18.79264 (13 April low) become viable if the corrective decline takes the pair below 19.15202.

GBP/ZAR: Daily Chart