- Summary:

- What is the outlook of the GBP/USD pair ahead of the upcoming BOE financial stability report? We explain the outlook of the GBP to USD.

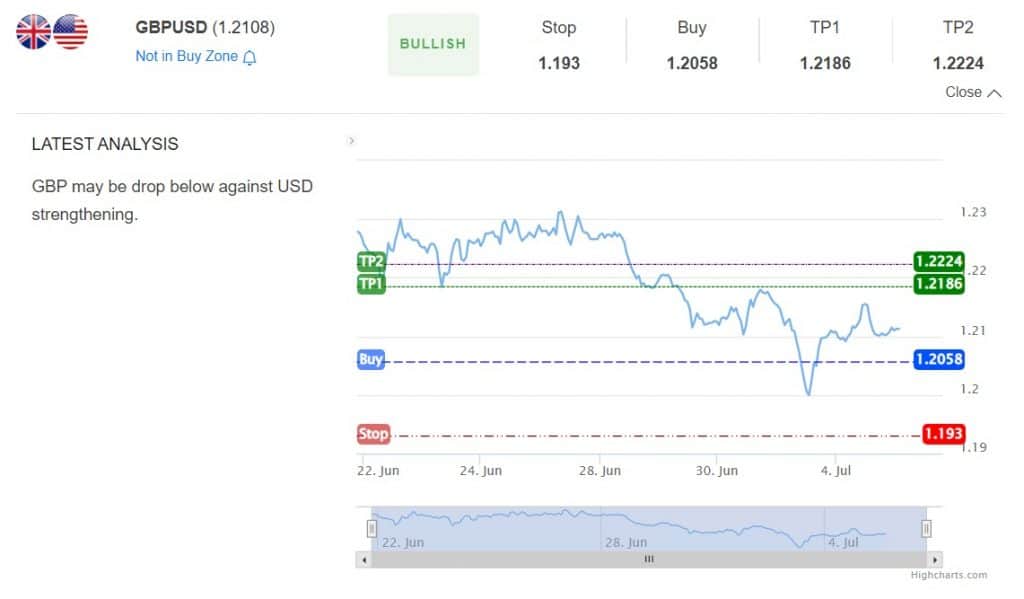

The GBP/USD price is moving sideways as investors position themselves for the new month and quarter. It is trading at 1.2107, which is slightly below Monday’s high of 1.2166. This price is also slightly above last week’s low of 1.1975. So, what’s ahead for the GBP to USD exchange rate?

BOE financial stability report

The pound to dollar exchange rate has been in a consolidation phase as the market focus on the hawkish tone by the Federal Reserve and the Bank of England (BOE). In June, the two banks decided to hike interest rates in a bid to fight the rising inflation. The Fed increased rates by 0.75% while the BOE made its fifth straight 0.25% hike.

The next key catalyst for the GBP/USD price will be the upcoming financial stability report by the Bank of England. This is a closely watched report that provides more information about the state of the UK economy and banking sector. Most importantly, the report is usually followed by a statement by the BOE governor as UK inflation rises.

Therefore, with the UK economy deteriorating, analysts will focus on the tone of the BOE governor. The bank is between a rock and a hard place considering that the UK is going through its first stagflation in a long time. The economy is expected to have contracted in Q2 while inflation was at the highest point in more than four decades.

The other important numbers that will have an impact on the GBP to USD exchange rate are the upcoming services and composite PMIs. Most importantly, the US will publish the latest jobs numbers this week.

GBP/USD forecast

Turning to the two-hour chart, we see that the pound to dollar pair rose and retested the important resistance point at 1.2166 on Monday. This was a notable level considering that it was the lowest levels on June 17th, 22nd, and 23rd. The pair is also slightly below the 25-period and 50-period moving averages while the RSI has moved to the neutral point of 50.

Meanwhile, a closer look shows that it has formed an inverted head and shoulders pattern. Therefore there is a possibility that the pair will have a bullish breakout as investors target the psychological level of 1.2200. On the flip side, a drop below the support at 1.2070 will invalidate the bullish view.

GBP to USD S&R levels

The bullish view is supported by InvestingCube’s S&R levels. The highly accurate robot predicts that the pound to dollar will rise to 1.2186 and then 1.2224. On the flip side, the key stops of this trade are at 1.2058 and 1.1930. You can subscribe to InvestingCube S&R indicator here.