- Summary:

- The GBP/TRY pair is expected to continue the correction if there is a rejection at the 20.45 resistance level.

After four days of relentless selling on the pair, the GBP/TRY pair is trading higher on the day. Investors shrugged off data released on Thursday that indicated a deficit in the UK current account in early 2022 to put the Pound on bid. However, the Pound continues to struggle for more significant bullish momentum after BoE Governor Andrew Bailey and incoming BoE board member Swati Dhingra’s comments indicated a slower approach to interest rate increases.

In contrast, the Lira gained some strength after the Turkish Central Bank (CBRT) kept interest rates steady at 14.00% despite rising inflation. Therefore, the GBP/TRY situation seems to be one of faltering GBP strength and the opportunity to earn from the interest rate differentials on both currencies.

Goldman Sachs projects that the 1-week repo rate in Turkey will remain at 14.00% until 2023, which will force real rates deeper into negative territory in Q4 2022. This is expected to lead to further inflation in Turkey, with 80% as the upper limit and 65.0% as the year-end downside limit. The current real rates in Turkey stand at -59.5%. The GBP/TRY is up 0.54% as of writing.

GBP/TRY Forecast

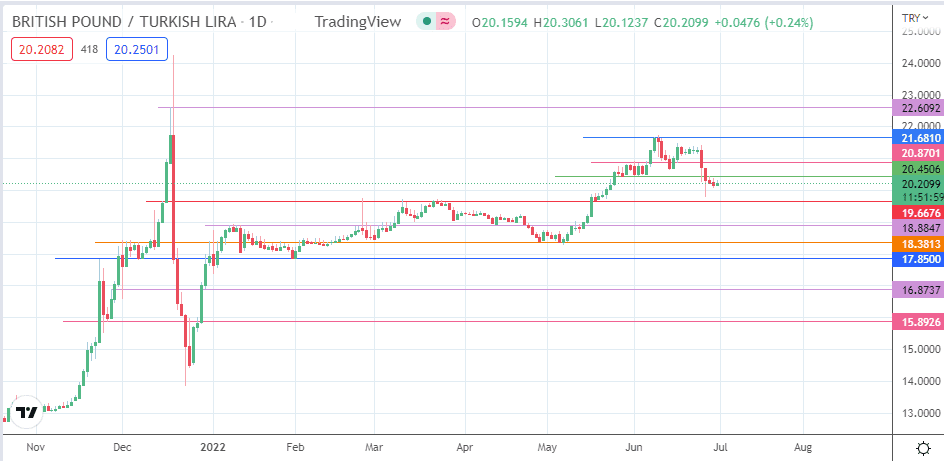

The intraday uptick will challenge the 20.4506 resistance line. Rejection at this level followed by a pullback will enable the bears to question the support at 19.6676 (22 March high/18 May low) to target the pivot below at 18.8847 (10 May 2022 high). Other pivots are domiciled at 19.3813 (28 April and 9 May 2022 lows), and at 17.8500, where the 7 December 2021 and 31 January 2022 lows are found.

On the flip side, a break of the resistance at 20.4506 enables the bulls to push toward the 20.8701 resistance, acting as the immediate northbound target and site of the 1 June high. A further push to the north uncaps this barrier and gives the bulls access to the 21.6810 resistance. 22.6039 (17 December 2021 high) and the 24.2411 price mark (all-time high seen on 18 December 2021) are the additional targets to the north which become viable on a further advance.

GBP/TRY: Daily Chart