- Summary:

- The GBP/TRY is down for the 5th straight day as the relentless selloff on the British Pound continues ahead of next week's MPC hearings.

The GBP/TRY pair continued the downward retracement from its August 2022 tops, which also housed the year-to-date highs. This decline follows further misery for the British Pound, which continues to face relentless selling in the market as various headwinds play out.

Goldman Sachs has made a grim call on inflation, predicting annualized consumer prices to rise by 22.4% in 2023 if natural gas prices continue to rise unabated. This figure is far above the Bank of England’s projection of a 13.3% peak in the consumer price index. Added to this headwind is the podcast call by BoE policymaker Catherine Mann, who has highlighted that rising prices would damage British businesses.

The new UK Prime Minister will be known by next week. The new PM will inherit an economy projected to contract by 3.4% if Goldman Sachs’ inflation outlook is realized.

The Bank of England’s Monetary Policy Report Hearings are the major fundamental trigger for the Pound next week, followed a week later by the latest consumer inflation data (14 September) and the BoE’s interest rate decision (15 September).

In the meantime, the GBP/TRY is down for the 5th straight day and is trading 0.52% lower currently.

GBP/TRY Forecast

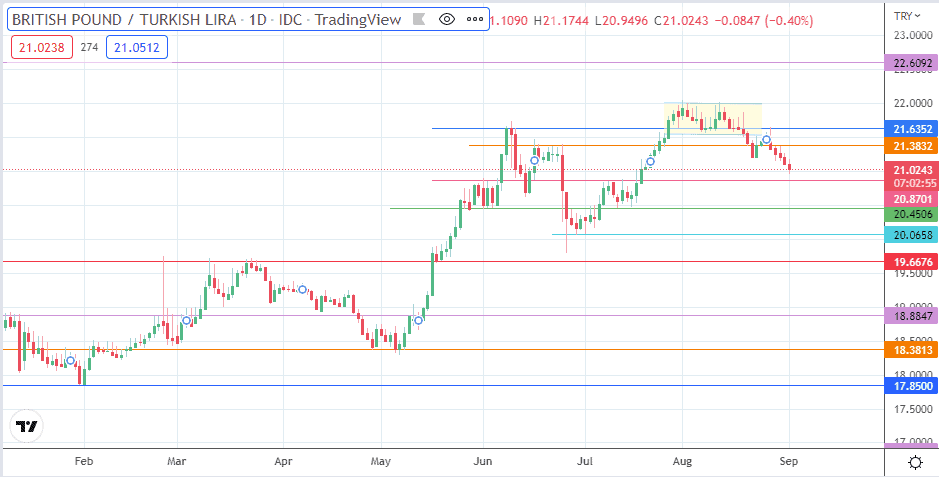

The 26 August penetration close below the 21.3832 support (20-25 June highs and 25 August low), along with that candle’s bearish engulfing of the 25 August candle, set the stage for the corrective decline that now targets the 20.8701 support (16 June low and 13 July high). If the bulls fail to defend this pivot, the retracement extends toward 20.4506 (3 June and 12 July lows). Further price deterioration makes 20.0658 the next viable target to the south. If the decline extends below this 29 June low, 19.6676 (18 May low) becomes the next downside target.

This outlook is negated if the price finds support at 20.8701, followed by a bounce that aims to restore the uptrend. This bounce would need to break above the 21.3832 resistance and the 21.6352 barrier (8 June and 26 August highs) to restore this outlook. A further advance aims for the 1-11 August peaks at the 22.000 psychological resistance barrier. Only when this is breached will the bulls have clear skies to pursue a multi-year target at 22.6092.

GBP/TRY: Daily Chart