- Summary:

- The GBP/INR price continued its bearish trend as the sterling continued its sell-off. The GBP to INR exchange rate dropped to a low of 94.41

The GBP/INR price continued its bearish trend as the British pound continued its sell-off. The GBP to INR exchange rate dropped to a low of 94.41, which is about 8% below its highest level in January of this year. The Sterling has also crashed to the lowest point since 2020 against the US dollar.

UK and Indian divergence

The GBP/INR price has crashed this year as investors focus on the divergence between the Indian and UK economies. India has seen a strong economic recovery in the past few months. For example, the country’s economy has surged and is approaching $3 trillion. As a result, the country has moved to become the fourth-biggest economy. It is bigger than the UK and France.

India has benefited from the ongoing crisis in Ukraine. It has managed to make deals with Russia that have made it scoop cheap oil and gas. All this has made the cost of products a bit cheaper. On the other hand, the UK economy is struggling. For example, rail workers voted to go on the biggest strike in over 25 years while inflation surged to the highest point in over four decades.

The GBP to INR pair has also declined because of the ongoing political crisis in the UK. Boris Johnson decided to resign last week. More than ten individuals have submitted their proposals to become the next premier. Therefore, the pair has dropped because of the political uncertainty in the UK. On the positive side, there is a possibility that the UK and India will reach a trade deal in the coming months.

GBP to INR prediction

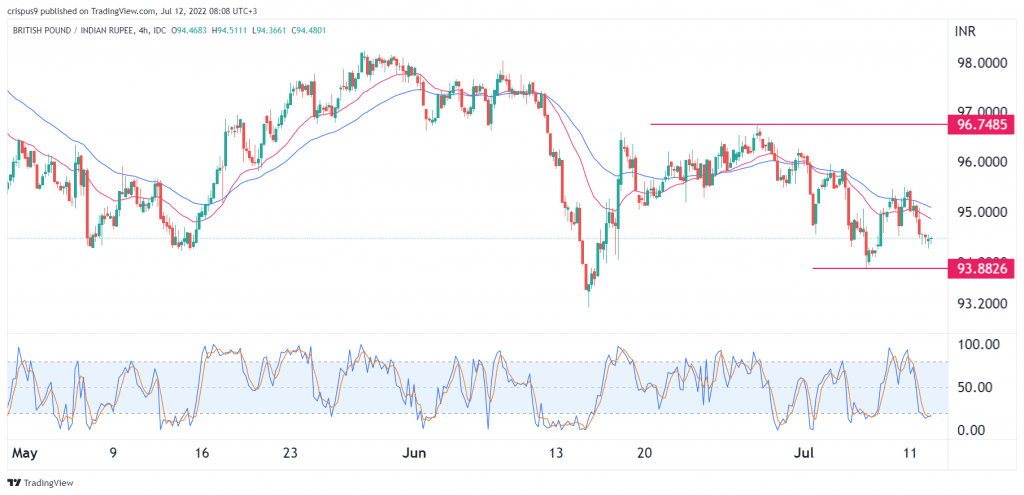

The four-hour chart shows that the GBP/INR price has been in a strong bearish trend in the past few days. The coin has dropped below the 25-day and 50-day moving averages while the Stochastic Oscillator is pointing downwards. It has moved below the important resistance level at 96.74, which is about 2.4% below the highest level in June.

Therefore, the GBP to INR will likely keep falling as sellers target the next key support at 93.88. This price is at the lowest level since June 15th. A move above the resistance at 94.8 will invalidate the bearish view.