- Summary:

- The GBP/JPY price pulled back sharply during the Asian session as investors watched the ongoing policy divergence between the BoE and BoJ

The GBP/JPY price pulled back sharply during the Asian session as investors watched the ongoing policy divergence between the BoE and BoJ. The GBP to JPY exchange rate dropped to a low of 164.60, which was about 1% below the highest point this week. It is about 2.7% above the lowest point this month.

BoE vs BoJ divergence

The GBP/JPY price has struggled for direction in the past few days as the market reflects on the differences between the BoE and the BoJ. The BoJ, which welcomed two new members this week, has maintained an extremely dovish tone. While other central banks like the BoC, ECB, and Swiss National Bank have hiked interest rates, the bank has maintained negative rates.

The BoJ is worried that higher interest rates will push Japan to a deep recession considering that wage growth has stalled. The bank also wants to stimulate inflation considering that it has spent the last decade hoping that consumer prices will hit its 2% target.

Meanwhile, the GBP to JPY price has reacted to the hawkish meeting by the Bank of England (BoE). Unlike the BoJ, the BoE has delivered several rate hikes and hinted that it will continue pushing rates higher in the coming months. That’s because the country’s inflation has risen to the highest point in over three decades.

GBP/JPY forecast

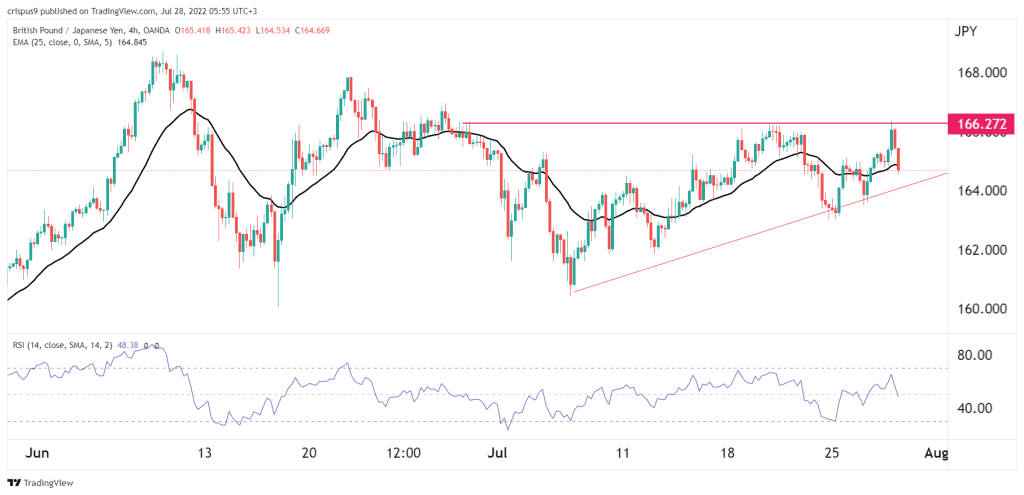

The four-hour chart shows that the GBPJPY price recovery found a strong resistance at 166.27. It has failed to move above this level several times this month. The pair appears to have formed an ascending triangle pattern that is shown in red. In most cases, this pattern usually leads to a bullish breakout when it reaches its confluent level.

Therefore, the GBP/JPY cross will likely remain in this range for a while as focus shifts to next week’s Bank of England decision. It will then have a bullish breakout to about 170 since the bank will likely deliver its first 0.50% hike this year.