- Summary:

- The GBP/JPY price pulled back slightly on Thusday as investors reflected on the recent economic data from the UK.

The GBP/JPY price pulled back slightly on Thursday as investors reflected on the recent economic data from the UK. The GBP to JPY exchange rate was trading at 162.60, which was slightly lower than this week’s high of 163.53.

UK inflation and retail sales ahead

The GBPJPY price declined slightly as investors reacted to the latest economic data from the UK. The numbers revealed that the UK inflation surged to the highest level in decades. Precisely, inflation rose by 10% in July of this year. Producer inflation also continued rising as the cost of fuel jumped.

These numbers came a day after the UK published relatively weak jobs numbers. The unemployment rate rose slightly to 3.8% while the number of vacancies dropped slightly. The next key catalyst for the GBP/JPY price will be the upcoming retail sales data scheduled for Friday this week.

With inflation at an elevated level, analysts believe that the country’s retail sales declined by -0.2% in July this year after falling by 0.1% in the previous month. This decline will translate to a year-on-year decline of 3.3%. Excluding the volatile food and energy prices, analysts believe that the country’s retai sales fell by 3.1% in July.

The GBP/JPY will also react to the latest Japan inflation numbers that are scheduled for Friday. Economists believe that the country’s inflation rose slightly from 2.2% to 2.4%. Still, this inflation is significantly below that of other countries. The Bank of Japan will likely continue maintaining its low-interest rates.

GBP/JPY forecast

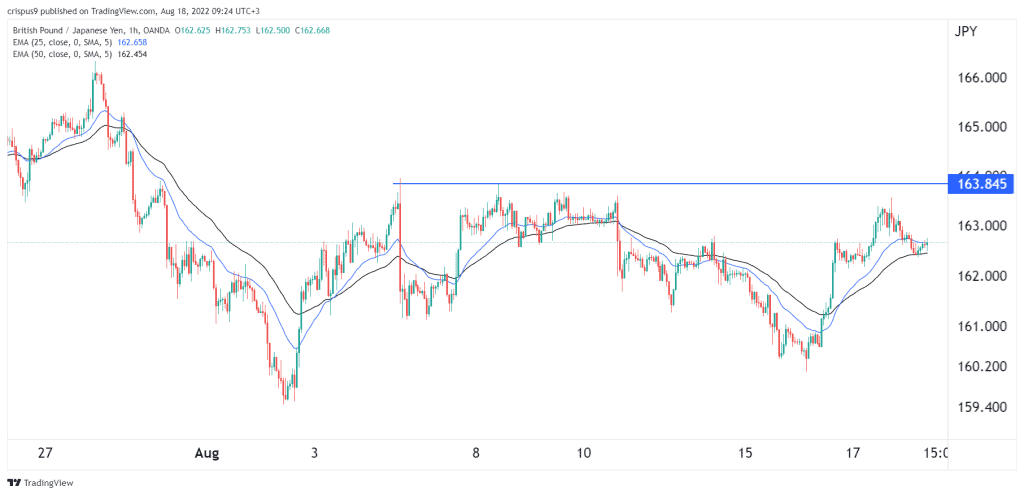

The hourly chart shows that the GBP/JPY price pulled back slightly after rising to a high of 163.56 on August 17. It is now trading at 162.63, which was slightly below the highest point this week. Also, it has moved to the 25-period and 50-period moving averages and is lower than the important resistance level at 163.84. It seems like it has formed a multiple-top pattern whose neckline is at 160.

Therefore, the pair will likely continue falling as sellers target the key support level at 160. However, a move above the resistance point at 163.85 will signal that there are still more buyers in the market.