- Summary:

- GBPUSD is the only underperformer today as it trades 0.05 percent lower at 1.2738 amid Tory leadership controversy during the weekend and despite USD

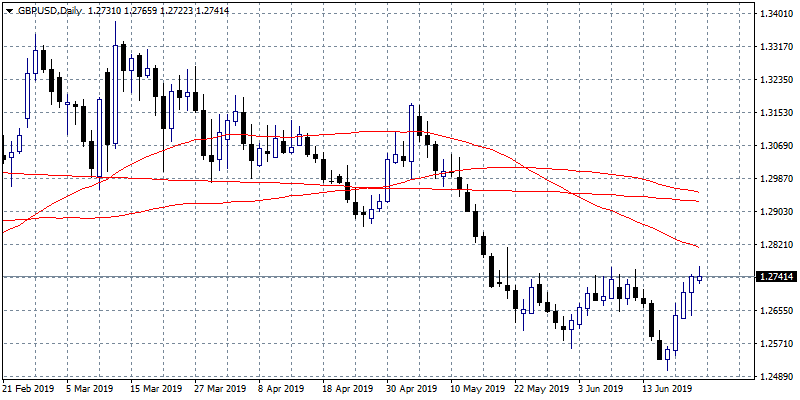

GBPUSD is the only under-performer today as it trades 0.05 percent lower at 1.2738 amid Tory leadership controversy during the weekend and despite USD weakness. Pound got a boost the previous week after FED left interest rates unchanged as widely expected by markets and changed its language to more dovish amid growing global trade fears. Bank of England also kept interest rate unchanged at 0.75% as widely expected. Meanwhile no Deal Brexit fears resurface as Boris Johnson is the favorite to move in to Downing Street replacing Theresa May.

Pound started the week higher at 1.2765 but sellers stepped in and dove the price down to daily low at 1.2722 and returned into the well established trading range between 1.2680 and 1.2740 that was active for over three weeks. Bulls got the short term control as the pair holds above all the major hourly moving averages. Support for the pair stands at 1.2713 the 50 hours moving average, while if broken might accelerate the slide further towards 1.2653 and the 100 hour moving average. On the upside if the pair manages today to close above 1.2765 might continue with an attempt to 1.28 and then to 1.2820 where the 50 day moving average cross.