- Summary:

- The GBP/INR is trading higher for the third day in a row as rising oil prices weaken the Rupee...but for how long?

The GBP/INR pair is trading higher for the third straight session as the Indian Rupee continues to face pressure from resurgent oil prices and persistent foreign portfolio outflows. Crude oil prices on the Brent benchmark are trading higher on the day, gaining 1.74% after the G7 agreed to study capping mechanisms on Russia’s oil imports into member nations.

Crude oil prices are on a 4-day winning streak as UAE says it cannot offer spare capacity to replace Russia’s oil should an embargo be implemented. The rise in crude oil prices puts pressure on importer nations such as India, which is number three on the list of crude oil-importing nations.

The Rupee is also feeling pressure from the higher interest rate environments in the G7 currencies, promoting investment flows out of emerging markets and into USD-denominated and Pound-associated assets.

The GBP/INR is up by 0.09% after losing some of the day’s gains. The pair’s upside could be capped by negative fundamentals emanating from the United Kingdom, as Scotland’s Nicola Sturgeon has set a date for a new Scottish referendum just a day after the UK Parliament voted to scrap the Northern Ireland Protocol.

GBPINR Outlook

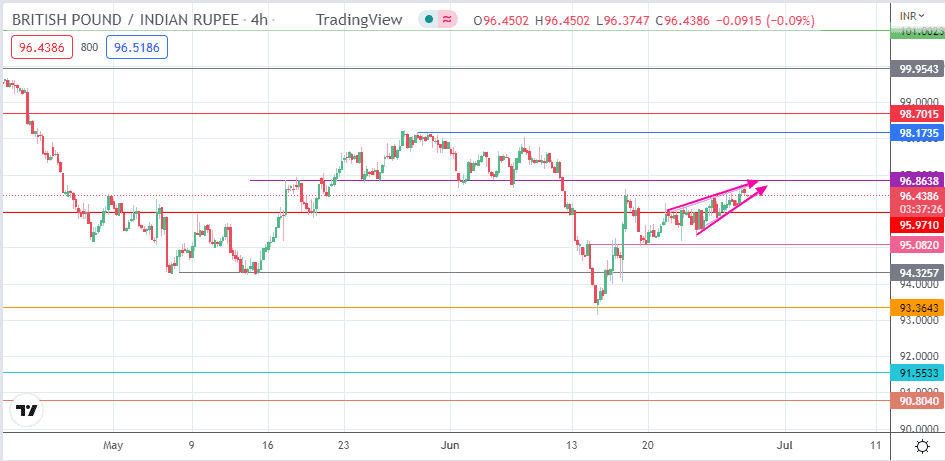

The 4-hour chart shows price consolidating within a rising wedge formation, which is still in evolution. The decline in the active 4-hour candle comes off a rejection at the wedge’s upper border. The wedge will be complete if the price candle breaks below the lower border of the wedge, targeting the 95.9710 support level. Below this level, the 95.0820 price mark serves as an additional support target. 94.3257 and 93.3643 are other targets that could serve as harvest points for the bears if the price deterioration is extensive.

On the other hand, the bulls must break the 96.8638 resistance to restore the recovery bias. This move will also leave clear skies to aim for the 98.1735 resistance. 98.7015 and 99.9543 are additional targets to the north which become available if the recovery on the pair is extensive.

GBP/INR: Daily Chart