- Summary:

- The GBP/INR price collapsed to the lowest level since 14th June this year as concerns about the UK economy continued.

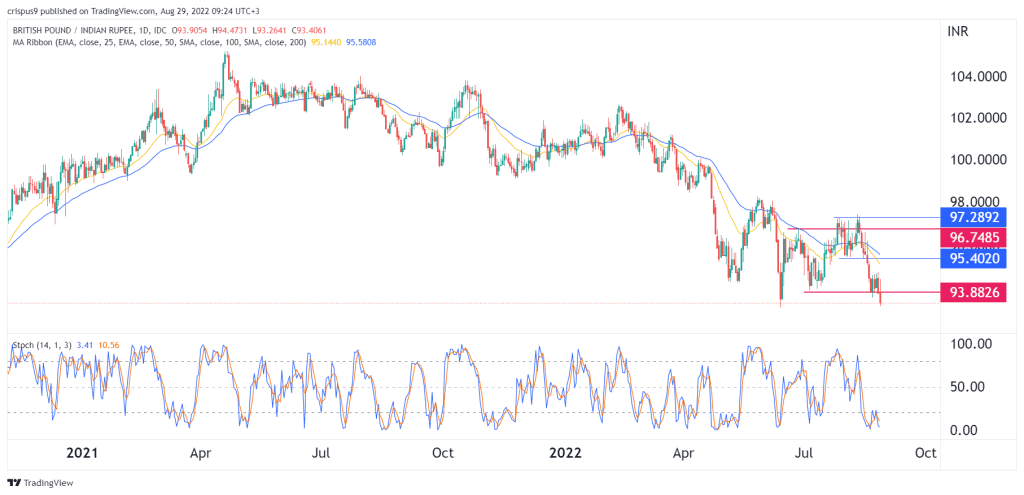

The GBP/INR price collapsed to the lowest level since 14th June this year as concerns about the UK economy continued. As a result, the exchange rate has slipped to 93.33, which was about 11% below the highest level in 2021. It has also diverged from the USD/INR, which has risen close to its all-time high.

UK and India divergence

The GBP to INR exchange rate has been in a strong bearish trend in the past few weeks as the divergence between the UK and Indian economies continues. However, the Indian economy has continued doing relatively well this year. This is partly because the Indian government has struck deals with the Russian government that has seen it buy cheap oil and gas.

On the other hand, the UK economy is going through major challenges as the cost of energy jumps. Last week, a report by Citigroup said that the country’s inflation will rise to 18.3% by January 2023. In a separate report, the Bank of England said that inflation will rise to 13%, while another one by Goldman Sachs estimated that inflation will hit 15%. Last week, Ofgem decided to hike energy costs by 80%, and analysts expect the situation will continue.

The GBP/INR price has fallen as the divergence between the Reserve Bank of India (RBI) and the Bank of England (BoE). Analysts expect the BoE will continue hiking rates in a bid to fight inflation while the RBI is expected to go slow on its rate hikes.

GBP/INR price forecast

The four-hour chart shows that the GBP to INR has been in a strong bearish trend in the past few weeks. It managed to move below the important support at 93.88, which was the lowest level on July 6. The pair has moved below the 25-day and 50-day moving averages. The Stochastic Oscillator has moved below the oversold level.

Therefore, the pair will likely continue falling as sellers target the next key support to watch will be at 90. A move above the resistance level at 94.75 will invalidate the bearish view. The bearish view is in line with my previous GBPINR forecast.