- Summary:

- Lower crude oil prices and the sudden resignation of the UK's Chancellor of the Exchequer have pushed the GBP/INR lower.

The GBP/INR pair lost 0.69% on Tuesday after the crash in oil prices benefitted the Rupee, the currency of the world’s third-largest importer of crude.

Brent crude fell $14 on Tuesday in its most significant one-day drop since 9 March, as fears of a global recession set off risk aversion and safe-haven plays. This allowed the Rupee to extend its recent gains against the Pound.

An improvement in the Nikkei Services PMI from 58.9 in May to 59.2 in June, beating market estimates of 58.7, also provided additional tailwinds for the Rupee in the absence of market-moving data from the UK. The Pound was also pressured late in the session by the sudden resignation of the UK Chancellor of the Exchequer, Rishi Sunak.

GBP/INR Outlook

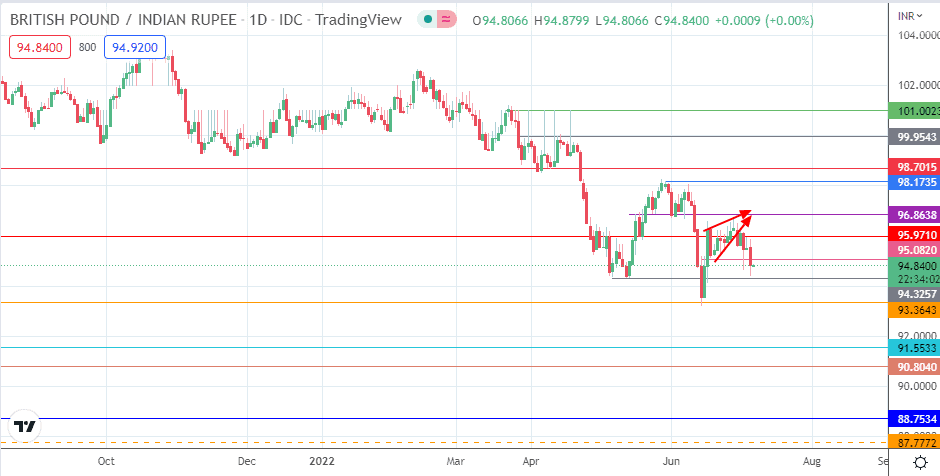

The low of the Tuesday candle at 94.3842 marks the end of the measured move from the rising wedge. However, a further slide in price toward the 14 June low at 93.3643 will only happen if the bulls fail to defend this support. If this move plays out, the bears would need to degrade that support level if additional targets to the south at 91.5533 (27 November 2019 low) and 90.8040 (25 October 2019 and 11 November 2019 lows) are to be attained.

On the flip side, the bulls need a sequential break of 95.0820 (14 June high), 95.9710 (4 July high) and the 96.8638 price resistance (17 May 2022 high) to clear the pathway towards the previous double top at 98.1735. Above this level, 98.7015 and 99.9543 (13 April 2022 high) are additional targets to the north.

GBP/INR: Daily Chart