- The GBP/INR price pulled back to the lowest level since August 8th of this year ahead of important economic data from the UK

The GBP/INR price pulled back to the lowest level since August 8th of this year ahead of important economic data from the UK. The GBP to INR exchange rate dropped to 95.80, which was about 1.67% below the highest level this month. The price is about 2.5% above the lowest point this year.

UK inflation and jobs data

The GBP to rupee exchange rate dropped ahead of the latest UK jobs that will come out on Tuesday morning. Economists expect the numbers to show that the country’s unemployment rate remained unchanged at 3.8% in June this year. They also expect that the average earnings ex-bonus rose from 4.3% to 4.5% while with bonuses fell to 4.5%.

The next important data will be the upcoming UK consumer and producer inflation data scheduled for Wednesday. Unlike in the United States, analysts believe that the country’s inflation continued rising, with the headline CPI nearing 10%. Sadly, the situation will likely continue worsening because of the rising natural gas prices. As winter approaches, the UK does not have enough storage facilities.

The GBP/INR price will also react to the latest UK retail sales and Indian trade numbers. Economists believe that UK retail sales continued to suffer as inflation soared in July. Meanwhile, the Bank of England (BoE) and the Reserve Bank of India (RBI) will likely continue hiking interest rates in the coming months.

GBP/INR forecast

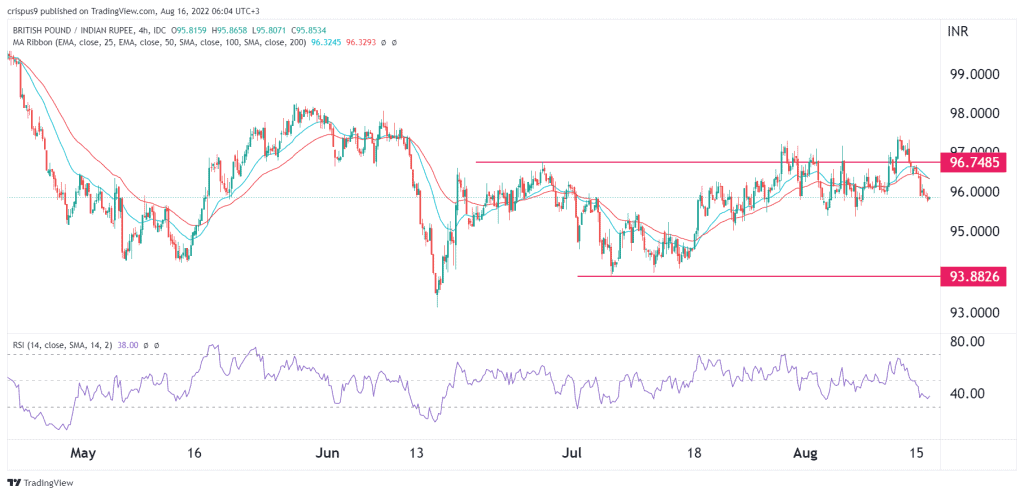

The four-hour chart shows that the GBP to INR exchange rate continued its bearish trend in the overnight session. It has already dropped below the important support at 96.74, which was the highest point on June 28. At the same time, the pair has moved below the 25-day and 50-day moving averages (MA) while the Relative Strength Index (RSI) dropped below the neutral point at 50.

Therefore, the pair will likely continue falling as sellers target the next key support at 95. A move above the resistance level at 96.26 will invalidate the bearish view.