- Summary:

- The GBP/CHF has resumed the selloff in response to the dire economic outlook provided by the Bank of England after yesterday's rate decision.

The GBP/CHF pair has surrendered all earlier gains made on the day and is now 0.14% in negative territory. This follows a resumption of the selloff on the British Pound following Thursday’s gloomy economic outlook from the Bank of England.

On Thursday, the Bank of England executed the largest single-day rate hike in 27 years when it raised interest rates by 50 basis points. However, it warned of a prolonged recession that could last more than a year, asking the UK public to brace up for the worst living conditions in more than 60 years. The bank also predicted a spike in the consumer price index to 13.3% annually by the end of the year, a more dire estimate than its earlier projection of 10%.

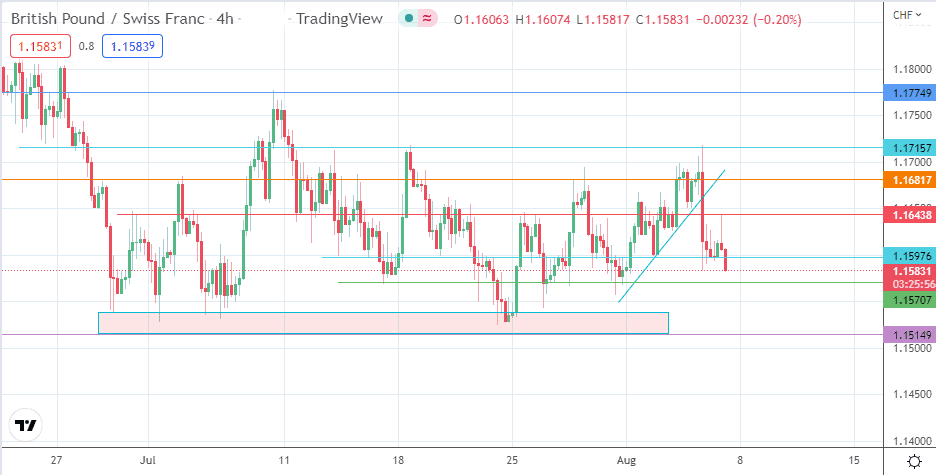

The pessimistic forecast set the tone for a significant selloff on Thursday on several GBP pairs, with the GBP/CHF falling by 0.5%. After a retracement on Friday morning, which met resistance at the 1.16438 price mark, the selloff has resumed, and the pair could extend the downside if Thursday’s low is breached.

GBP/CHF Forecast

The weakness spurred by yesterday’s BoE decision could carry into next week. As it is, the pair has violated the support at 1.15976 but needs a closing penetration below the 4 August candle at 1.15825 to get a clear passage towards the 1.15707 support (27/31 July lows).

Additional support lies at the 1.15500 psychological price point, just above the low of the 21 July candle. Below this level, the demand zone formed by 1.15149 – 1.15383 enters the mix as the major support for the price action.

Conversely, this outlook is negated if the bulls save the 1.15976 support. This scenario will see the bulls aim for a test of the intraday high at 1.16438. A breakout from here leads to an upward march toward the 1.16817 resistance level (4 July/27 July highs). Above this level, additional resistance is found at the 1.17157 price mark (18 July high). The bulls have to uncap this price level before the 1.17749 price barrier, site of the high of 8 July, to enter the mix as an additional northbound target.

GBP/CHF: 4-hour Chart