- Summary:

- The GBP/CAD price dropped to the lowest point since Wednesday as investors refocused on the upcoming UK GDP data

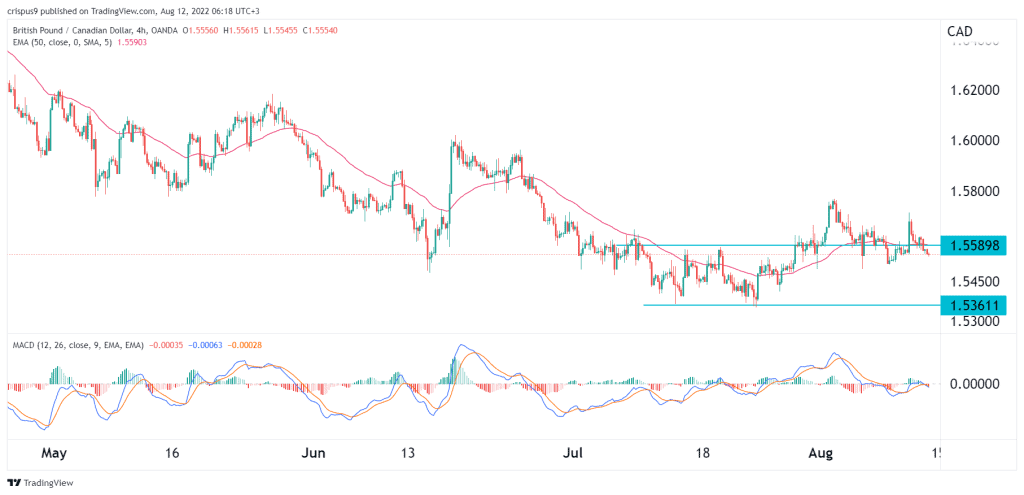

The GBP/CAD price dropped to the lowest point since Wednesday as investors refocused on the upcoming UK GDP data and the rebounding crude oil prices. The pair fell to a low of 1.5546, slightly below this week’s high of 1.5720.

UK GDP data and oil prices

The GBP to CAD exchange rate dropped below the important support at 1.5590 ahead of the GDP numbers. Economists expect the numbers to reveal that the British economy contracted in June and the second quarter. Precisely, they believe that the economy contracted by 1.2% in June after expanding by 0.8% in May.

For the quarter, analysts expect that the economy contracted by 0.2% after expanding by 0.8% in Q1. Additional data are expected to reveal that the country’s trade deficit widened from over 21.4 billion pounds to 22 billion pounds. Manufacturing and industrial production are expected to have dropped by 1.8% and 1.3%, respectively.

The GBP/CAD price has also retreated as the price of crude oil made some modest gains. Brent, the global benchmark, rose to $99.09 while the West Texas Intermediate rose to $93.81. This price action happened after the International Energy Agency (IEA) raised the global demand outlook. It cited the use for oil in power generation as Russia continues to squeeze Europe with natural gas.

GBP/CAD forecast

The four-hour chart shows that the GBP to CAD exchange rate dropped below the critical support level of 1.5590. This was an important price since it was the highest point on July 19th of this year. It has managed to move below the 25-day moving average while the MACD has moved below the neutral point.

Therefore, the pair will likely continue falling as sellers target the middle of the horizontal channel at 1.5450. A move above the resistance point at 1.5645 will invalidate the bearish view.