- Summary:

- The GBP/AUD pair is up for a second day after UBS published its preview of the BoE decision in which it expects a 25bps hike.

The uptick in the GBP/AUD pair today comes after UBS released its preview of next week’s Bank of England decision. The Swiss investment bank expects the BoE to hike its interest rates for the 5th time by 25 bps on 4 August. This move will take the interest rates to 1.5% if it happens.

In the last meeting, the BoE had said it would not rule out a 50bps rate hike if it saw a persistent pattern of inflationary pressure. Data that has come out since then in terms of employment, GDP, inflation and retail sales have been largely mixed. This could give the BoE some room to adopt a more cautious approach with its tightening policy.

UBS feels that the drop in long-term inflation expectations on the part of consumers in June, along with concerns of the Pound being exposed to potential shocks from expectations of more significant hikes down the road, may cause the BoE to go for a more modest upward adjustment. But you never know as the FOMC proved in last month’s meeting when it hiked by 75 bps when the market expected a 50 bps move to the upside.

Also up for consideration is how the BoE intends to handle sales of the gilts it has acquired over time. The MPC is to vote on whether the sales will start in September, representing a quantitative tightening that could strengthen the Pound in the coming months. The GBP/AUD pair is up 0.32% as of writing.

GBP/AUD Outlook

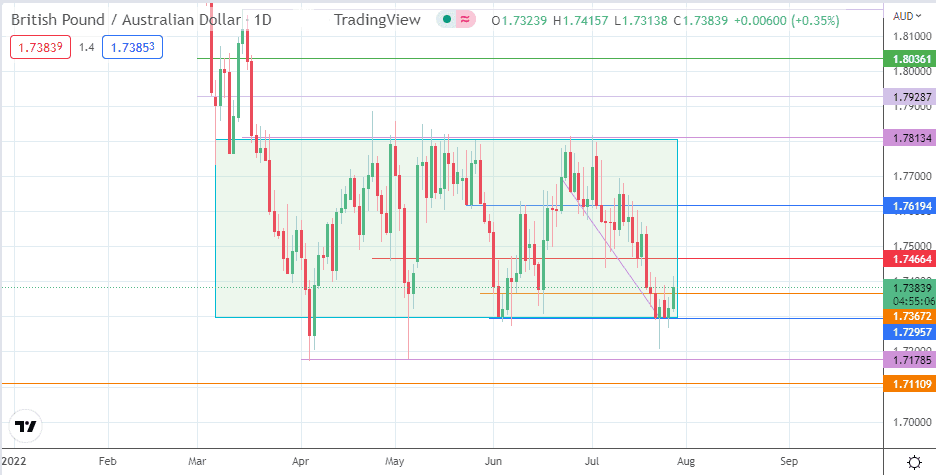

The uptick comes from a bounce on the 1.72957 support, which also acts as the floor of the rectangle pattern. This follows several attempts at degrading this pivot without success. The uptick has violated the resistance at 1.73672 (1 June low), but the bulls need a conclusive break above this level to aim for additional upside targets at 1.74664 and 1.76194 (24 May low, 10 June high). 1.78134 is the ceiling of the rectangle and the next target in line for the bulls if they uncap 1.76194.

On the other hand, the bears would be seeking to break down the rectangle, targeting 1.717850 initially (5 April and 5 May lows). 1.71109 is an additional target to the south that comes into the mix if the bears degrade the previous support.

GBP/AUD: Daily Chart