- Summary:

- The GBP/AUD price retreated slightly ahead of the latest UK GDP numbers and as the political field to replace Boris Johnson narrowed.

The GBP/AUD price retreated slightly ahead of the latest UK GDP numbers and as the political field to replace Boris Johnson narrowed. The GBP to AUD exchange rate dropped to 1.7582, which is slightly below this week’s high of 1.7693.

UK GDP data

The pound to Australian dollar pair declined slightly as the Office of National Statistics (ONS) prepares to deliver the latest UK GDP numbers. Economists polled by Reuters expect the data to show that the country’s economy rose slightly in May. Precisely, they see the economy growing by 0.1% in May after falling by 0.3% in April. Analysts also believe that the economy expanded by 2.7% in Q1.

The ONS will also publish other important economic numbers. For example, economists expect that the country’s construction output grew by 4.4% in May while industrial production contracted by 0.3%. Manufacturing production, on the other hand, rose by 0.2%.

These numbers will come a few hours after Andrew Bailey of the Bank of England pledged to bring inflation to 2% in the coming months. That will be a tall order considering that inflation rose to a 40-year high of 9.1% in May of this year. The bank also believes that it could rise to 11%.

In the statement, he also hinted that the bank will likely move above its usual 0.25% rate hike. Analysts expect that the BOE will hike by 50 bases in the next meeting. The GBP/AUD price is also reacting to the leadership contest to replace Boris Johnson. Eight candidates moved to the next stage on Tuesday. Now, analysts believe that the competition will be between Rishi Sunak and Liz Truss.

GBP/AUD forecast

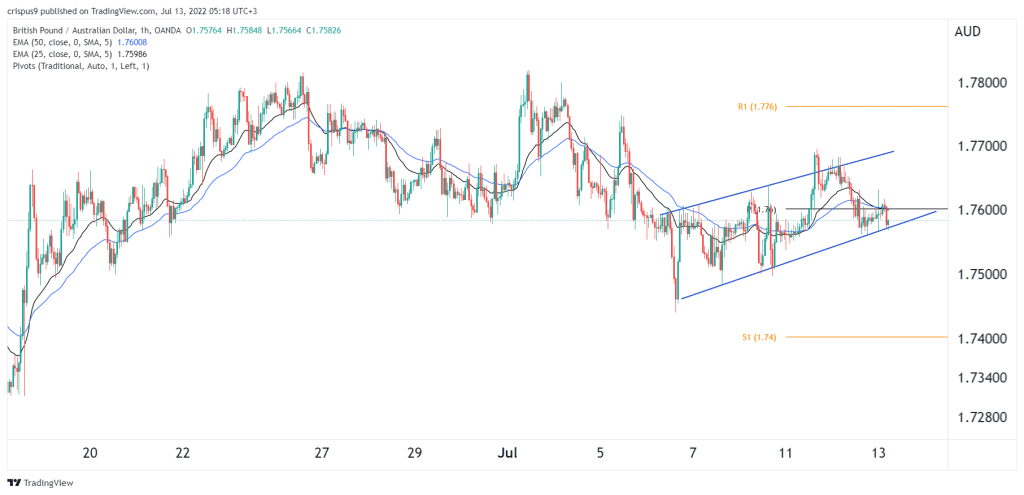

The hourly chart shows that the GBP to AUD exchange rate has moved sideways in the past few days. Now, the pair has moved slightly below the 25-period and 50-period moving averages. It has also moved slightly below the standard pivot point. The pair is also along the lower side of the ascending channel pattern which is shown in blue.

Therefore, the outlook for the pair is bearish as long as sellers can support a move below the lower side of this channel. If this happens, the next key support to watch will be at 1.7500. A move above the resistance at 1.7630 will invalidate the bearish view.