- Summary:

- Investors attention will turn to macro data this week after the G-20 summit this weekend. Euro traders will closely follow the PMI figures

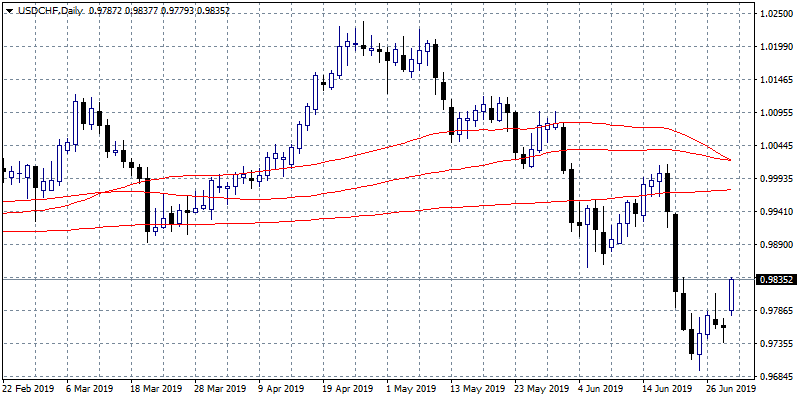

Investors attention will turn to macro data this week after the G-20 summit this weekend. Euro traders will closely follow the PMI figures from Germany and France and also from Spain Italy and the EU, while the UK June manufacturing PMI will be released at 08:30GMT. The Germany June unemployment rate change will be released at 07:55GMT. From Switzerland, USDCHF traders await the May retail sales data, and the SNB total sight deposits for the week 28 June. Also from UK, pound traders expect the May mortgage approvals and credit data figures. The European calendar also includes the Eurozone May unemployment rate which will provide a cue for the health of the EU economy.

In the American calendar we await the US manufacturing PMI releases, both from ISM and Markit, at 14:00GMT.

During the Asian session the Japanese June consumer confidence index came in at 38.7 versus the expectations of 39.2. The Australia Manufacturing PMI for June came in at 49.4, the prior reading was at 52.7. The China Manufacturing PMI for June came in at 49.4 while the Services PMI came at 54.2.Don’t miss a beat! Follow us on Twitter.