- The FTSE 250 and FTSE 100 indices have come under intense pressure in the past few weeks as concerns about the UK economy remain.

The FTSE 250 and FTSE 100 indices have come under intense pressure in the past few weeks as concerns about the UK economy remain. The blue-chip FTSE 100 index has plunged by about 10% from its highest point this year. On the other hand, the small-cap FTSE 250 index has pulled back by 17% from its August high and by 30% this year.

UK fiscal situation

The key catalyst for the FTSE 100 and FTSE 250 indices will be the fiscal crisis engulfing the UK. This crisis started shortly after Lizz Truss and Kwasi Kwarteng unveiled their mini-budget in September. On Friday, Truss announced that she was replacing Kwarteng in a bid to boost confidence on the economy.

Still, there are concerns about whether the move will be enough since some Tory members want her out of 10 Downing Street. If this happens, her term will be the smallest in modern history.

The FTSE 250 and 100 indices are also reacting to the ongoing corporate earnings from the UK and the United States. According to FactSet, 7% of all companies in the S&P 500 have already published their results. Of these companies, 69% have published a positive EPS surprise while the blended earnings growth of 1.6% was the lowest since 2020.

The next key catalyst for the FTSE 250 will be the upcoming earnings from American giants like Bank of America, Goldman Sachs, Morgan Stanley, Tesla, and Netflix. While these are primarily American companies, they usually set the tone for global equities. Besides, the FTSE 100 index has a close correlation with its American counterparts.

Asos, Rio Tinto, Centamin, Deliveroo earnings ahead

The FTSE 100 and FTSE 250 indices will also react to earnings from key UK companies. Rio Tinto share price has crashed to the lowest point since September ahead of its earnings scheduled for Tuesday. These results will likely show that the company’s profits held steady even as commodity prices pulled back.

Meanwhile, Asos share price has plunged by 67% from its highest point in June as demand and high cost of doing business has risen. The stock is now trading at the lowest level since 2010. Other UK retailers like Boohoo, Tesco, Ocado, and Marks and Spencer have also crashed. Asos will publish its results on Wednesday.

Dunelm share price has crashed by over 45% this year as high cost of doing business and low demand has continued. The company will publish its results on Thursday. Meanwhile, Deliveroo share price has been in freefall amid low demand. The fallen angel will publish its results on Friday.

Other FTSE 250 constituents that will publish their results are Travis Perkins, London Stock Exchange, IHG, Centamin, and Antofagasta.

FTSE 250 forecast

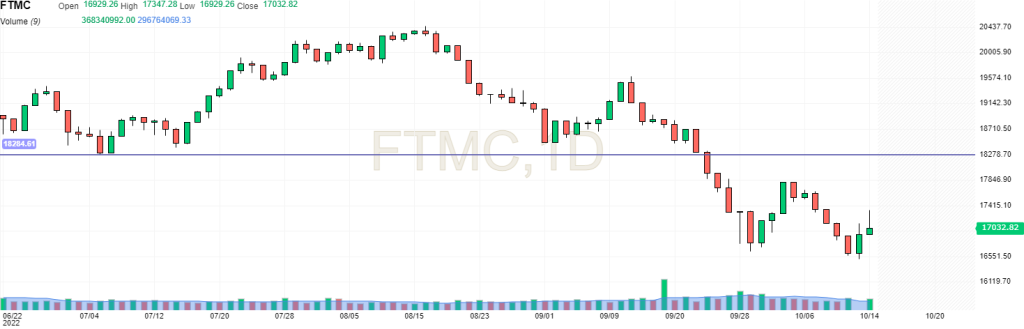

The daily chart shows that the FTSE 250 index has been in a deep sell-off in the past few months. It crashed below the important support at 18,497, which was the lowest level on September 1. The index has also moved below all moving averages. It has also formed a small double-bottom pattern.

Therefore, there is a likelihood that it will have a brief relief rally as buyers target the key level at 18,500. A drop below the support at 16,700 will invalidate the bullish view.