- Summary:

- We look at the top performers in the FTSE 100 and why they have defied gravity. We also explain whether they will do well.

The FTSE 100 index is not having a good year. Like other American and European indices, it has crashed into a correction zone as the crisis in Russia has escalated. A closer look at most of its constituent companies shows that they have fallen by double-digits. This includes well-known British brands like Flutter Entertainment, Sage, Ocado, Melrose, and Aveva. But some have defied gravity.

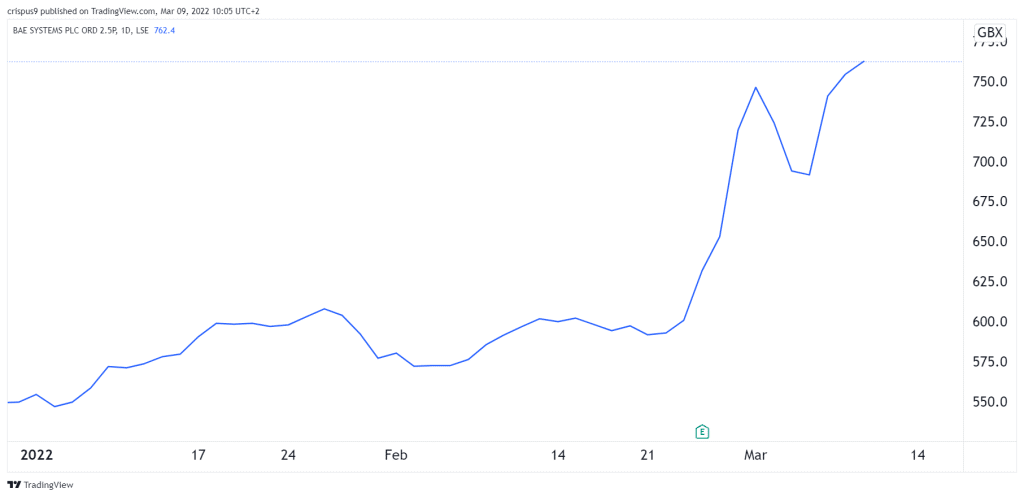

BAE Systems

The BAE Systems share price has jumped by more than 37% this year, making it the best performing FTSE 100 stock. While other companies have suffered because of the Ukraine crisis, the company has done well because of its industry.

It is a leading defence contractor that will benefit as the UK and other countries boost their defence spending going forward. The UK government has also increased its spending on the company buying more weapons to send to Ukraine. However, the biggest challenge for BAE Systems is the rising cost of doing business as the price of key inputs like copper, steel, and aluminium rise.

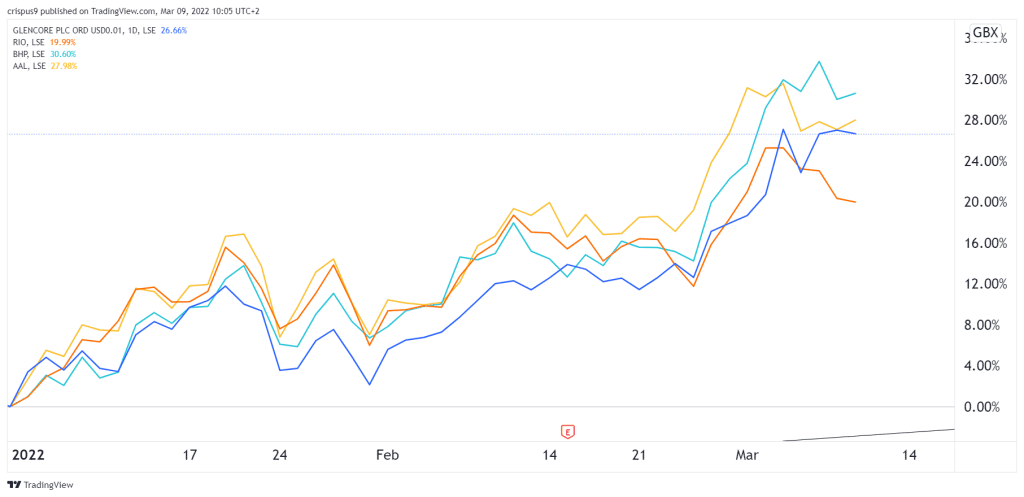

Anglo American

This year, the Anglo American share price has jumped by 27% share price, making it the second- performer in the FTSE 100 index. This performance is mostly because of the rising prices of the commodities the company mines and the fact that it does not have a major presence in Russia. So, for example, it’s core coal, copper, and platinum products have risen sharply this year.

Coal has risen as many companies boost their stocks as energy prices rise. Platinum and palladium prices have also risen because of Russia’s role in the industry. Most importantly, Anglo American is a leading producer of nickel, whose price has jumped by more than 200% in the past few days.

In line with Anglo American, the Glencore, BHP, and Rio Tinto share prices have also risen by more than 26% because of the rising commodity prices.

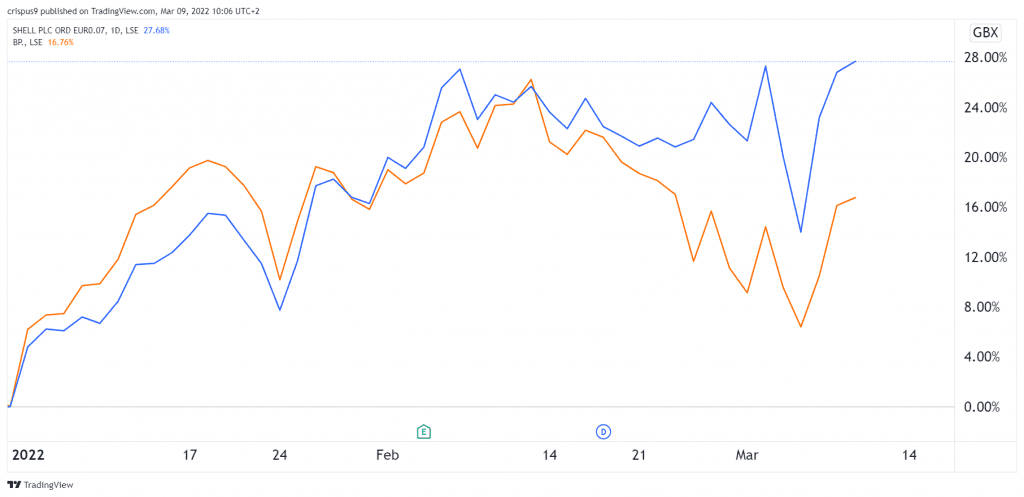

Shell and BP

The Shell share price has risen by 25% because of the rising crude oil and gas prices. In the same period, the BP share price has jumped by about 14%. These companies are bound to benefit from the spectacular performance of oil and gas.

However, they have both suffered a setback after exiting the highly profitable Russian market. This week, Shell said that it will completely exit its Russian operation. Still, doing this will possibly benefit the companies in the long term.