- Summary:

- FTSE 100 gives up 0.14% at 7,259 below the monthly highs as no-deal Brexit worries eased while Halifax House Prices (3m/YoY)came in at 1.8%

FTSE 100 gives up 0.14% at 7,259 below the monthly highs as no-deal Brexit worries eased while Halifax House Prices (3m/YoY)came in at 1.8% below expectations of 3.4% in August. The monthly Halifax House Prices (month over month) came in at 0.3% topping expectations of 0.2% in August.

FTSE 100 getting a boost from Smurfit Kappa +2.54%, Berkeley Group +2.09%, Hargreaves plc +1.33% and Croda +1.32%. On the other hand, Centrica is -3.33% United Utilities is –3.19% and Severn Trent is -2.52% lower.

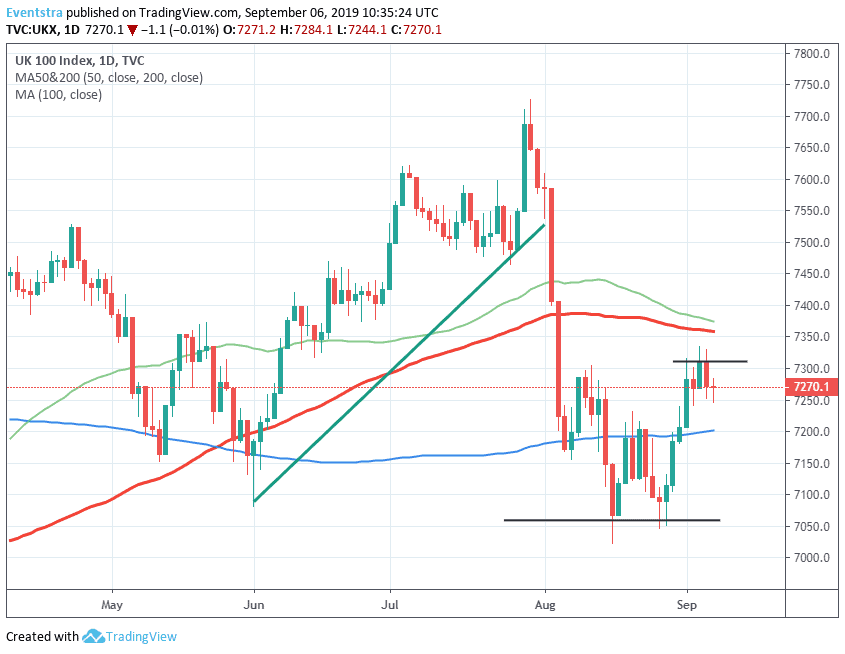

On the technical side FTSE 100 holds above the 50 day moving average today despite the slide yesterday and today as it digests the impressive rebound from four-month lows. The index facing the resistance at 7,310 weekly high and then at 7,358 the 100-day moving average which is critical for the FTSE’s moves in the upcoming trading sessions; a close above could open the way for 7,374 and the 200 day moving average. On the downside immediate support stands at 7,244 today’s low, while a break below will open the way for a test of 7,060 low from August 16th.

European indices also trading higher, with DAX 30 adding 0.28% to 12,160 while the CAC 40 in Paris trading 0.06% lower at 5,589, In Milan the FTSE MIB is giving up 0.06% at 21,940.

In Wall Street, the Dow Jones futures trading 0.28% higher at 26,775, the S&P 500 futures are 0.25% higher at 2,979 while the Nasdaq futures are 0.14% higher at 7,866 signaling a positive start for equities in the other side of the Atlantic.