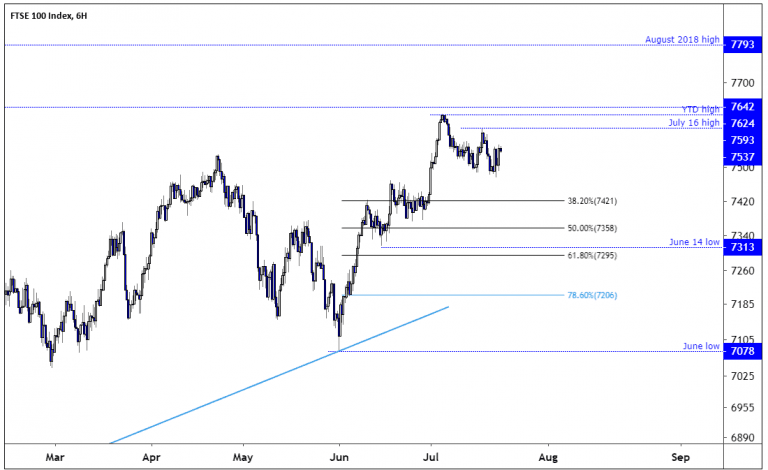

- FTSE 100 struggles to overcome resistance and remains mildly bearish as the market digests its 2019 gains, and traders take time off to enjoy the summer.

At the time of writing, the FTSE 100 was up by 33 points, as the price added to its gains after stabilizing from the 7475 level on Friday. However, the immediate price trend of the FTSE 100 was still bearish, and the price will probably need to overcome the July 16 high of 7593 for the short-term trend to turn upwards.

The struggle of the FTSE 100 is similar to the DAX 30, and the S&P 500 index. Both the German DAX, and S&P 500 had a bullish spell from the start of 2019, and the latest bull leg in the FTSE 100 started from the June low at 7078. As traders now digest the 2019 gains and traders taking time off for the summer, the FTSE 100 has slowly drifted lower since reaching its YTD high of 7624 on July 4.

As mentioned above, the trend would need to break the July 16 high to turn bullish, and until this happens, the index might drift lower. As the multi-month trend remains firmly bullish above the June low of 7078, I suspect the stock index might find support between the 7313 to 7421 intervals before turning higher. The range is derived using Fibonacci from the June low to the YTD high, and the 7373 levels is the June 14 low.

Facebook Earnings July 24: Download our free FB earnings preview report today.

Don’t miss a beat! Follow us on Twitter.