- Summary:

- On the technical side FTSE 100 trades above the 200 day moving average today as it continues the rebound from four month lows. The index facing the

FTSE 100 is adding 1.03% at 7,281 today helped by a weak pound which trading below the 1.21 mark and despite United Kingdom Markit Manufacturing PMI came in at 47.4, below forecasts of 48.4 in August. Investors focus is on latest developments in China – US trade war and the new tariffs kicked in during the weekend.

FTSE 100 getting a boost from AstraZeneca +2.69%, Experian +1.95%, Diageo plc +1.91% and Tesco plc +1.87%. On the other hand NMC Health is -1.72% Antofagasta Holdings is –1.55% and Just Eat is -0.84% lower.

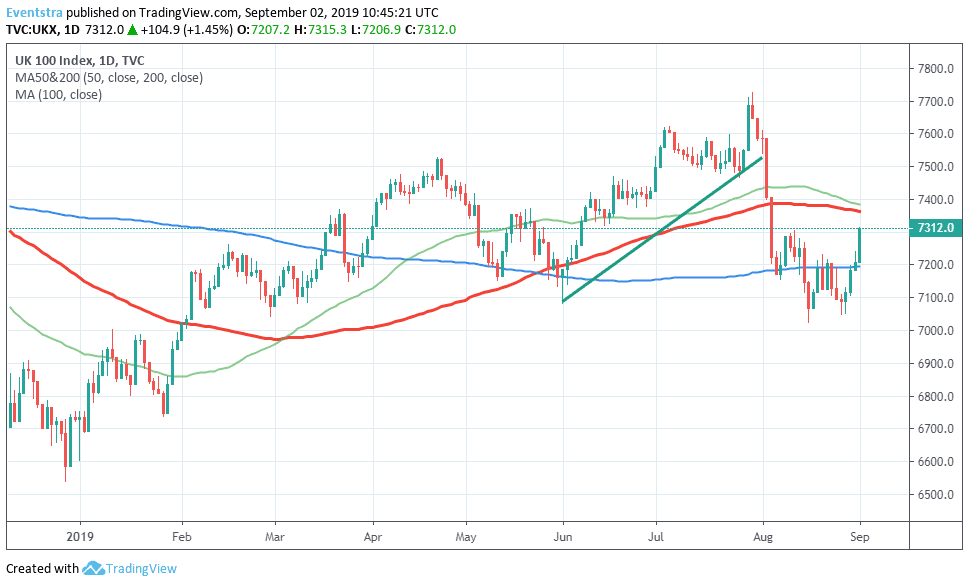

On the technical side FTSE 100 trades above the 200 day moving average today as it continues the rebound from four month lows. The index facing the resistance at 7,364 the 100 day moving average which is critical for the FTSE’s moves in the upcoming trading sessions; a close above could open the way for 7,385 and the 50 day moving average. On the downside immediate support stands at 7,206 today’s low, while a break below will open the way for a test of 7,060 low from August 16th.

European indices also trading higher, with DAX 30 adding 0.19% to 11,962 while the CAC 40 in Paris trading 0.17% higher at 5,489.

In Wall Street, the Dow Jones futures trading 0.41% lower at 26,296, the S&P 500 futures are 0.17% lower at 2,919 while the Nasdaq futures are 0.24% lower at 7,672 signaling a weak start for equities in the other side of the Atlantic.