- Summary:

- The FTSE 100 index remains weak despite recovering from earlier losses, as risk aversion continues to plague the markets.

The FTSE 100 index has overcome earlier losses in the session and is now trading in green territory. However, it remains weak as global stock markets remain risk-averse due to geopolitical tensions and a slew of PMI data pointing to growing manufacturing contraction.

Renewed US-China tensions over US House Speaker Nancy Pelosi’s Taiwan trip also spooked the markets, as China has vowed retaliation in response to the visit by the US House Speaker. Beijing views Taiwan as its territory, and visits by top US officials are seen as lending credence to that territory’s independence bid.

However, the FTSE 100 index bounced back from the losses as BP reported a 14-year high in its second-quarter profits on higher energy prices. BP climbed % on the day, as robust refining capacity and trade margins helped boost its repurchase programs and dividend payout potential.

Leading the gainers’ chart on the FTSE 100 index is BP, which topped the chart with a 3.58% gain, Pearson (3.54%), National Grid (2.73%), British American Tobacco (2.37%), and Standard Chartered (2.64%). Fresnillo led the losers’ chart, followed by Taylor Wimpey, which is down 4.45%, Barratt Developments (-4.09%), and Dechra Pharmaceuticals (-3.60%)

FTSE 100 Outlook

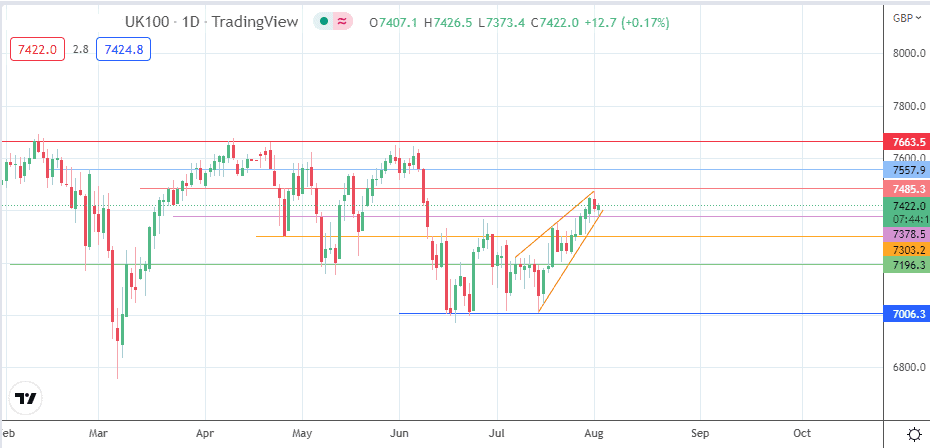

A break of the 7378 intraday support, which is also the 18 May low, also takes out the lower border of the rising wedge and completes the pattern. This creates a potential downward move that targets completion at the 7100 price support (11 July low).

To achieve this completion point for the measured move, the bears must degrade the support levels at 7303 (26 April low and 21 July high) and 7196, where the 21 June high is seen. 7006 forms additional price support, the previous bottom of the June-July 2022 price action.

On the other hand, a bounce on the 7378 support/wedge’s lower border will enable the bulls to challenge the resistance at 7485 (26 April high). A break above this level targets the 7557 resistance, thus invalidating the pattern. The 8/21 April highs at 7663 await the bulls if they successfully uncap the 7557 resistance barrier.

FTSE 100: Daily Chart