- Summary:

- What is the outlook of the FTSE 100 index as it forms a dead cat bounce? We explain why the current rally is real.

The FTSE 100 is crawling back as investors the recent sell-off eases. The index has risen by almost 1% after plummeting sharply in the past few weeks. It is trading at £7,285, slightly above this week’s low of £7,161. However, it remains about 5% below the highest level this year, meaning that it has performed better than other peers like Nasdaq 100, Dow Jones, and the DAX Index.

Bank of England warning

The FTSE 100 index has been in a downward spiral in the past few months as investors focus on the hawkish sentiment of the Bank of England (BOE). The bank started hiking interest rates in December last year as it attempted to deal with the soaring inflation. It has now hiked rates in all meetings it has held this year.

Historically, most stocks tend to underperform in a high-interest rate environment. Besides, companies will need to pay more money in interest rates. This is notable considering that companies in the UK and other markets went on a borrowing spree during the Covid-19 pandemic. Indeed, companies like Rolls-Royce, IAG, and Centrica have added loads of debt.

Notably, UK bank stocks have also poorly fared even as the BOE has boosted interest rates. Companies like Lloyds Bank, NatWest, and Standard Chartered have declined by more than 10% in the past few months.

However, a closer look shows that the FTSE 100 index has outperformed its American peers like the Nasdaq 100 and S&P 500 indices. This underperformance is mostly because FTSE index is made up of companies that are considered as being valuable.

On the other hand, the Nasdaq 100 and the S&P 500 are mostly made up of tech companies that have lagged. Indeed, well-known brands like Meta Platforms, Tesla, and Amazon have crashed in the past few months.

UK recession fears

The FTSE 100 index has declined sharply because of the raising worries about a recession in the UK. When making its decision last week, the Bank of England (BOE) warned that the UK could face a major recession in the next few quarters. It attributed this performance to the rising consumer inflation and potential challenges in the housing sector.

Recent data showed that the UK consumer price index (CPI) rose to the highest level in decades. And analysts expect that the state of stagflation will remain high for a long time. Worse, the producer price index has risen to uncomfortable levels, which has led to significantly lower margins.

The weak margins have been shown in the ongoing quarterly results. For example, Barclays, Tesco, Ocado, Boohoo, and Asos reported weak quarterly results. On the other hand, like Centrica, Shell, BP, and Lloyds Bank, some published strong results.

There are also worries about the housing sector. With interest rates rising, there are fears that the housing market will continue struggling in the coming years. These fears are reflected in the performance of UK housebuilders like Taylor Wimpey, Persimmon, and Barratt Developments have dropped by more than 10% from their YTD highs.

FTSE 100 top movers

Most companies in the FTSE index have declined this year. However, there are several top performers in the index. Most of these firms are companies in the energy industry. The best performers in the index are Shell, Glencore, BP, BHP, and Anglo American. These shares have all risen by more than 20% this year. Other top performers in the FTSE 100 index were BAE Systems, Standard Chartered, and AstraZeneca.

On the other hand, most companies in the index have been in the red. Some of the worse performers are Ocado, Scottish Mortage Investment Trust, ITV, Barratt Development, Rolls-Royce, and Ashtead.

FTSE index forecast

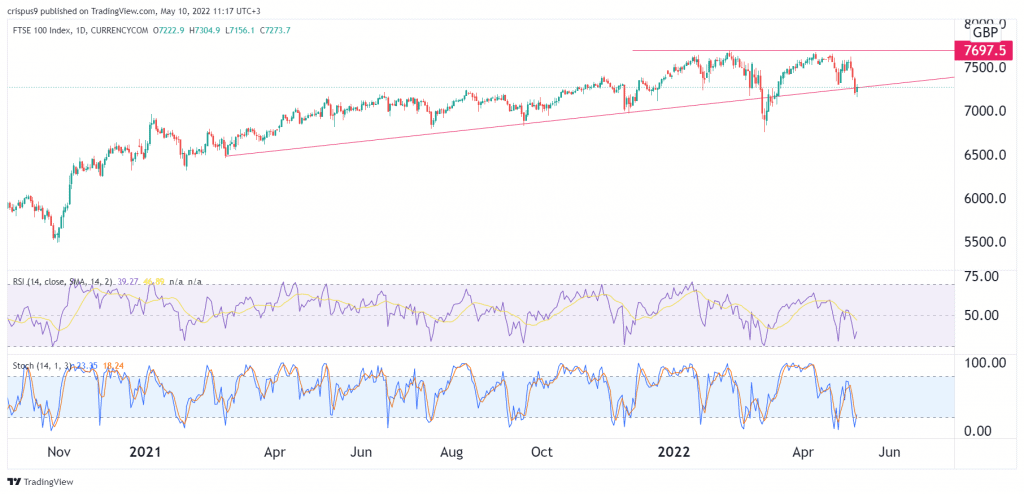

The Footsie index soared to a high of £7,697, where it faced strong resistance, as shown below. Since then, the index has declined and moved slightly below the ascending trendline shown in red. In addition, oscillators like the Relative Strength Index (RSI) and the Stochastic Oscillator have moved close to the oversold level.

Therefore, while the index has jumped by about 1% on Tuesday, it is in an overall bearish trend as risks rise. This means that this jump is merely a dead cat bounce, meaning that a drop to about £7,000 is still in the cards.