- Summary:

- The FTSE 100 index has not been spared in the ongoing global stock unraveling. What next for the index?

The FTSE 100 index has not been spared in the ongoing global stock unraveling. The index crashed by over 2.40% on Monday and futures are pointing to another 2.50% crash after the weak performance by American equities. The Footsie index has erased all gains it made this year.

Most stocks in the FTSE 100 index have declined this year. The worst performers in the index this year are companies like Halma, Dechra Pharmaceuticals, Croda International, Scottish Mortgage Investment Trust, RightMove, and Experian. Their share prices have crashed by double-digits in the past 30 days.

The Ocado share price has crashed by over 12% in the past 30 days and by 20% from its highest level this year. It has fallen by over 53% from its highest level in 2021 as concerns about the industry remains. This year, there are concerns about whether the company will return to growth as the UK reopens.

Royal Mail is another popular FTSE 100 stock that has tumbled this year. The Royal Mail share price is trading at 436p, which is the lowest level since November 17th. It has tumbled by about 17% below the highest level this year.

The Rightmove share price has dropped to the lowest level since July 2021 as concerns about the housing demand remained. It has dropped by about 20% from its highest level this year. Other housing stocks in the FTSE index like Persimmon, Barratt Development, and Taylor Wimpey have also crashed.

FTSE 100 forecast

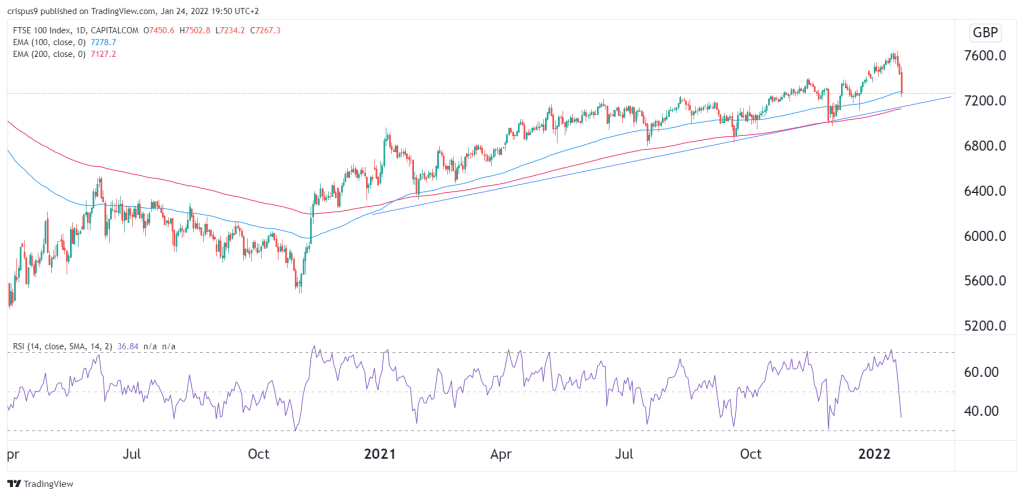

The daily chart shows that the FTSE 100 index has been in a strong bearish trend in the past few days. As a result, the index has moved below the 50-day moving average. Notably, it has moved to the 100-day moving average for the first time since December 20th.

Therefore, the index will likely continue dropping as investors target the 200-day moving average at around 7,135. This price was also along the ascending trendline. A move above 7,350 will invalidate the bearish trend.