- Summary:

- The FTSE 100 index is substantially cheap, according to analysts by JP Morgan. We explain what to expect in the near term.

The FTSE 100 index is hovering near its highest level in 2019 as UK stocks rebound. The Footsie has jumped by about 53% from its lowest level in 2020. It has still lagged the performance of its American peers, with the Dow Jones and S&P 500 trading at record highs.

UK stocks are dirt cheap

While the FTSE 100 index is trading near its highest level in 2019, analysts at JP Morgan believe that UK stocks are substantially cheap. They noted that these stocks are trading at a bargain compared to their American, European, and Asian peers.

This undervaluation is mostly because of Brexit and Covid-19. They also expect that the stocks will be boosted by the relatively weak sterling. In a note, they also moved their preference from the small-cap FTSE 250 to the FTSE 100 index.

Indeed, many American investors have began buying UK companies. A private equity company has already bought Morrison’s while Meggit is being acquired. And on Monday, Viasat announced that it will acquire Inmarsat in a $7 billion deal. Other deals announced recently include the Vectura acquisition by Philip Morris and the G4S acquisition by Allied Universal Security.

There have been acquisitions in the FTSE 100 as well. For example, Avast was recently acquired by an American company while Entain rejected a deal by DraftKings.

FTSE 100 forecast

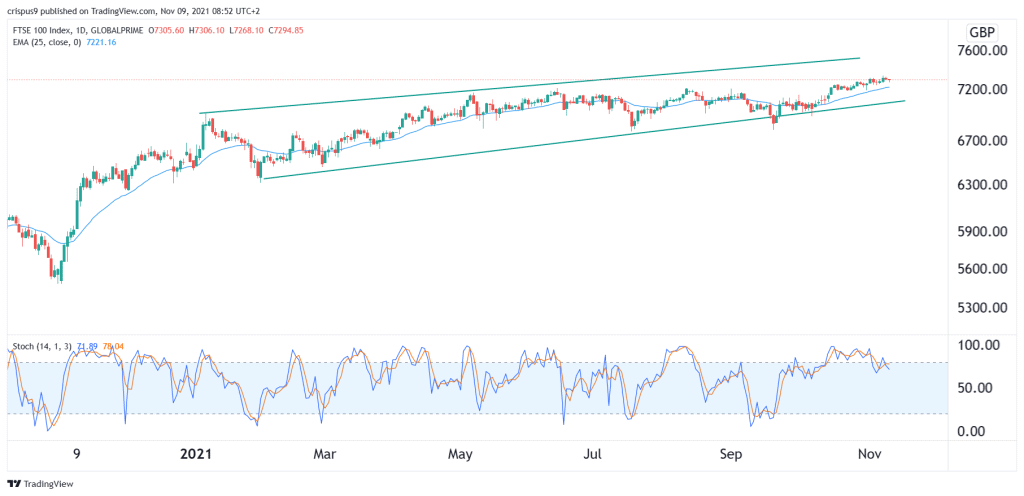

On the daily chart, we see that the FTSE 100 index has been in a steady bullish trend lately. It is between the ascending channel pattern that is shown in green. The index is also being supported by the 25-day moving average while the Stochastic Oscillator has formed a bearish divergence pattern.

Therefore, the index will likely keep rising as buyers target the upper side of the channel at about 7,500 pounds. This view will be invalidated if the price drops below 7,000 pounds.