- What is the outlook of the FTSE 100 index? We explain whether the index has more upside and whether it is a good buy.

The FTSE 100 index has had a spectacular recovery in the past few weeks. After plunging to a multi-month low of £7,161 in March, the index has risen by over 6.20% to the current £7,600. It is now hovering near the highest level since May 5th. This recovery has mirrored that of other global indices like DAX, Nasdaq 100, and CAC 40.

The FTSE 100 had an eventful month in May as many companies published their quarterly results. The best performing stock in the index was Flutter Entertainment, which rose by almost 20% after the firm published strong results. It was followed by Barclays, whose shares jumped by over 15%. Other top performers in the FTSE 100 index were companies like Melrose, Standard Chartered, BP, Next PLC, and Shell, among others.

Many FTSE 100 constituents were in the red as well. The worst-performers were companies like Carnival, Admiral Group, Croda, Diageo, and United Utilities, among others. Notable names like IAG, Tesco, and IAG were also in the red in May.

Looking ahead, June will be a bit calm for UK stocks since most of them have already published their quarterly results. However, the main catalyst for equities will be the Bank of England decision that is scheduled for June 16th. Analysts expect the BOE will hike interest rates by another 0.25% as its battle against inflation continues.

FTSE 100 forecast

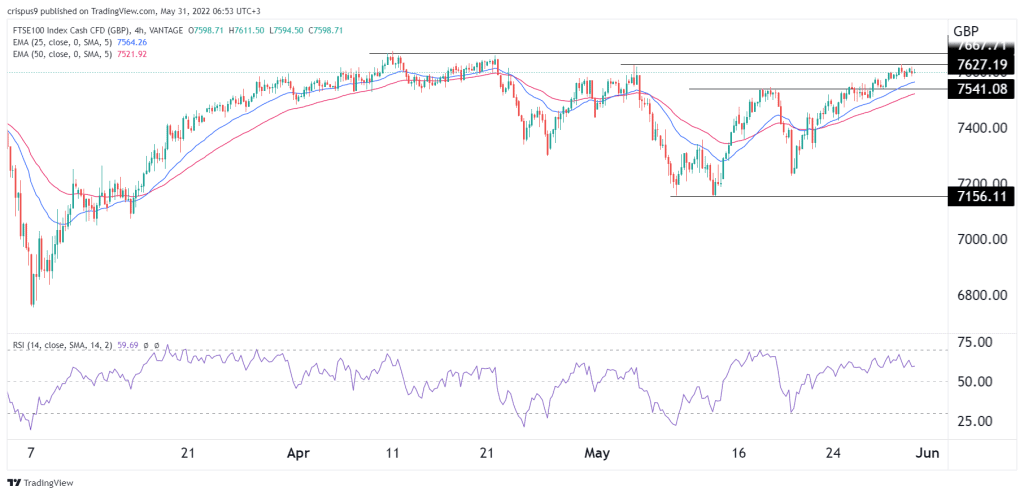

The four-hour chart shows that the FTSE index has been in a strong bullish trend lately. It has managed to move above the important resistance at £7,541, which was the highest level on May 17th. In addition, the index has moved above the 25-day and 50-day moving averages, while the Relative Strength Index has moved close to the overbought level. It is also slightly below the resistance at £7,627, which was the highest point on May 5th.

Therefore, the FTSE 100 index has more room to run as bulls target the important resistance at £7,667. However, a move below the support at £7,541 will signal that more sellers are still around and invalidate the bullish view.