- Summary:

- The FTSE 100 index records its best ever start to a new year, as it amasses gains of nearly 6% in the first trading days of 2021.

The FTSE 100 was one of the big winners of global stock indices, as it coasted to a 362-points gain this Wednesday, despite the impact of the national coronavirus-associated lockdown.

The resurgence in the FTSE 100 was led by banking stocks, which were sent soaring by rising bond yields. This has given the FTSE 100 its best start on record to a year, according to a fact check by Bloomberg. The previous record was held in 2009.

Investors are apparently pleased by the clarity which now exists, following the conclusion of the post-Brexit trade negotiations and eventual trade deal, which was also approved in uncharacteristically speedy fashion by the UK Parliament. Leading the charge on the FTSE 100 today were HSBC Holdings, Standard Chartered and Barclays, which rose 9.92%, 9.38% and 8.27% respectively. Natwest rose 7.21%, while Lloyds Banking Group rose 5.54% at the time of writing.

Technical Levels to Watch

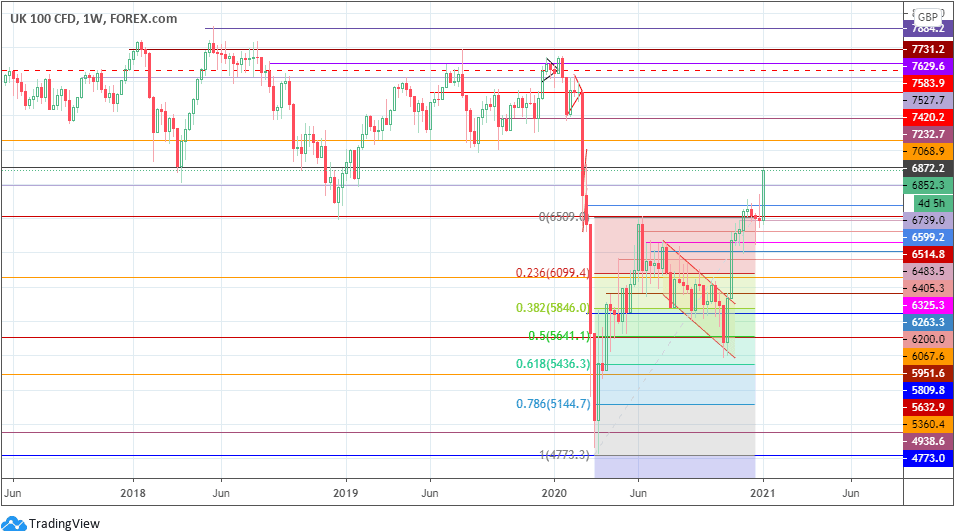

Today’s surge has put the resistance at 6872.2 at risk, with the likelihood of the FTSE 100 crossing the 7000-mark to hit 7068.9 if the surge continues. 7232.7 and 7420.2 are the next targets in line to the north.

On the other hand, we could see a decline towards 6739.0 if there is a rejection and pullback at 6872.2. Below this level, 6599.2 and 6514.8 form additional targets to the downside.

FTSE 100 Daily Chart