- Summary:

- The FTSE 100 index is tilting upwards as investors reflect on the new Plan B rules and the trading update by Rolls-Royce Holdings.

The FTSE 100 index is tilting upwards as investors reflect on the new Plan B rules and the trading update by Rolls-Royce Holdings. The index is trading at £7,365, which is slightly below this week’s high of £7,386.

The biggest catalyst for the FTSE 100 index is the new Plan B rules. The Boris Johnson administration will announce new rules to curb the spread of Covid-19. The new rules will include a mask mandate, work-from-home directives, and vaccine passports. The FTSE index is therefore tilting higher since analysts expect that these rules will not have a major impact on UK companies.

The key company to watch in the FTSE 100 will be Rolls-Royce Holdings. The company’s stock will be in the spotlight because of the worries of the Plan B rules on the aviation sector. It also annonced its latest trading statement.

The company said that it was making strong recovery even as challenges remain. It is on track to cut costs. It has already laid off more than 8,000 staff as it seeks to save more than £1 billion.

It also said that its large engine flying hours were at about 50% of 2019 levels and about 46% year-to-date. The company also saw strong growth in its Power Systems and Defence. The Rolls-Royce share price has risen by more than 10% from its lowest level in November.

FTSE 100 forecast

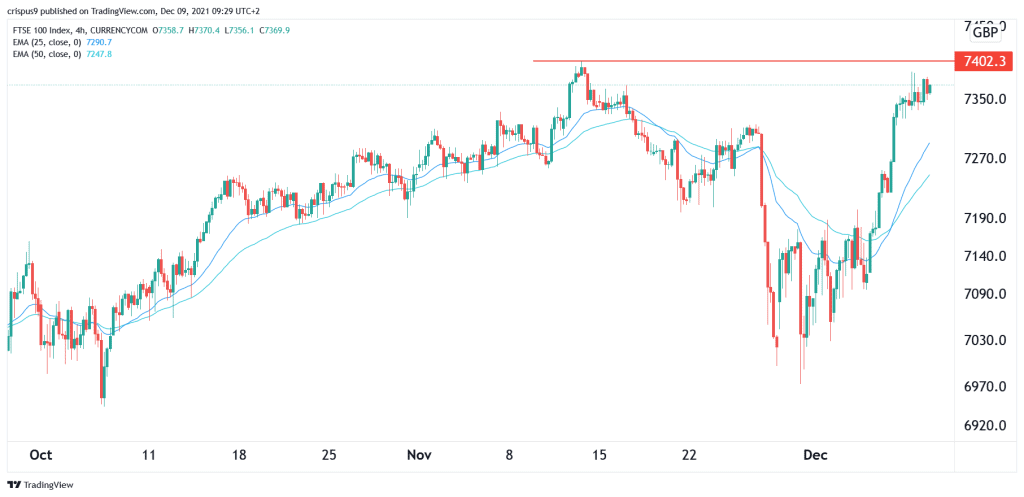

The four-hour chart shows that the FTSE 100 has made a spectacular V-shaped recovery in the past few days. It has recovered most of the losses it made when the Omicron variant was unveiled. It is a few points below its YTD high of £7,402.

It remains slightly above the 25-day and 50-day moving averages. Also, it has formed a bullish flag pattern. Therefore, while a pullback is possible, there is a likelihood that it will zoom above the resistance at £7,400 in the near term.